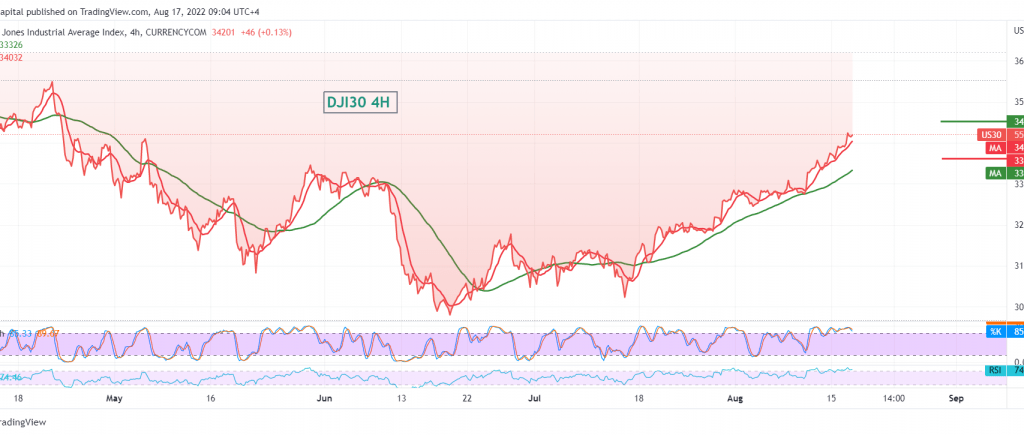

The Dow Jones Industrial Average continued forming the bullish attack to the upside, as we expected, touching the required official station of 34,210, recording its highest level at 34,265.

Technically, the relative strength continues to defend the bullish trend and is supported by the positive motive of the simple moving averages that continue to hold the price from below. From here, and with steady daily trading above 33,900, the most likely bullish scenario remains, targeting 34,260, considering that the breach of the mentioned level extends the index’s gains, opening the door to visit 34,345.

Note: UK inflation data, US retail sales data, and the results of the Federal Reserve meeting are due today, which are high-impact data; we may see high volatility in prices and all scenarios are on the table.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations