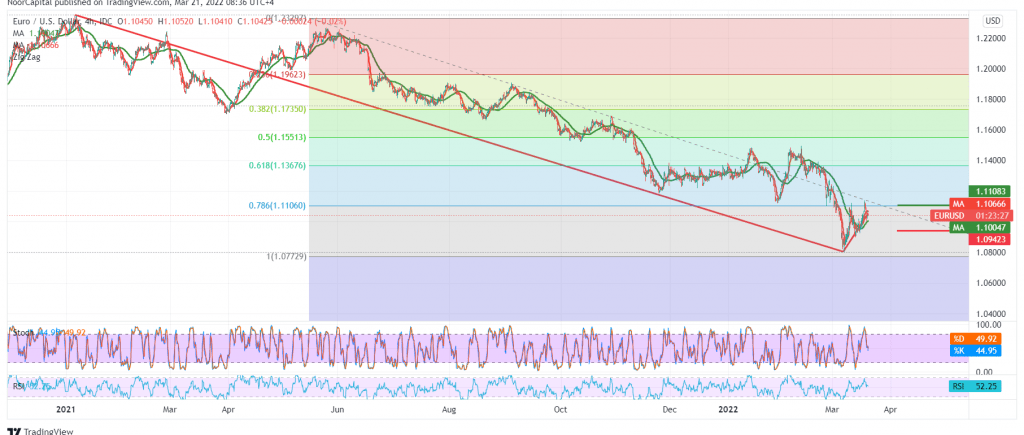

The EUR/USD ended its weekly trading below the psychological resistance level of 1.1100, which forced it to trade within the general bearish trend again.

On the technical side today, looking at the 4-hour chart, we notice the continuation of the negative pressure coming from the 50-day simple moving average, which puts negative pressures on the price and converges around the resistance level of 1.1065 and adds more strength, this comes in conjunction with the clear negative features on the stochastic.

Therefore, the bearish scenario may be the most likely to visit 1.0990/1.1000 as an initial price station, and it should be noted that the decline below 1.0990 will increase the strength of the daily bearish trend, so that 1.0940 will be the next price station.

The suggested scenario requires the intraday trading to remain below 1.1065, and in general below 1.1105, knowing that the attempt to consolidate above 1.1105 increases the possibility of retesting 1.1170.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0995 | R1: 1.1105 |

| S2: 1.0940 | R2: 1.1170 |

| S3: 1.0875 | R3: 1.1220 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations