US crude oil futures prices touched the first target at 81.00, to record its lowest level of 80.77.

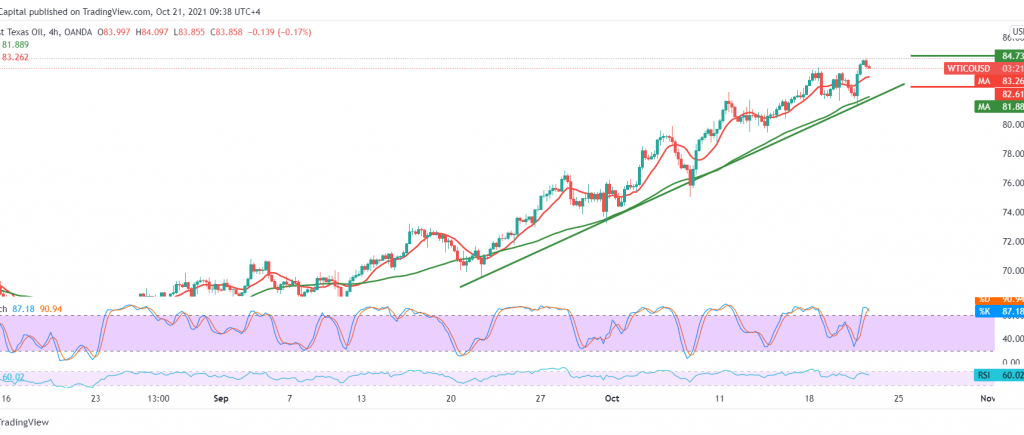

Technically, by looking at the chart, oil prices returned to test the key resistance level for the current bullish trend of 83.90. the RSI defended the bullish direction. On the other hand, trading remained below 83.95/83.90, with stochastic entering the oversold areas, which contradicts the factors mentioned above.

Therefore, we will stay on the fence until the technical picture becomes clearer, and we are waiting for the following pending orders:

The breach of 83.95 increases the current trend’s strength, targeting 84.60, a first target, and the gains may extend to visit 85.40.

The breach of the 82.60 support level leads the price to enter a bearish correction, with targets starting at 81.45 and 81.00, respectively.

Note: The risk level is high.

| S1: 81.45 | R1: 84.60 |

| S2: 79.50 | R2: 85.60 |

| S3: 78.30 | R3: 87.80 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations