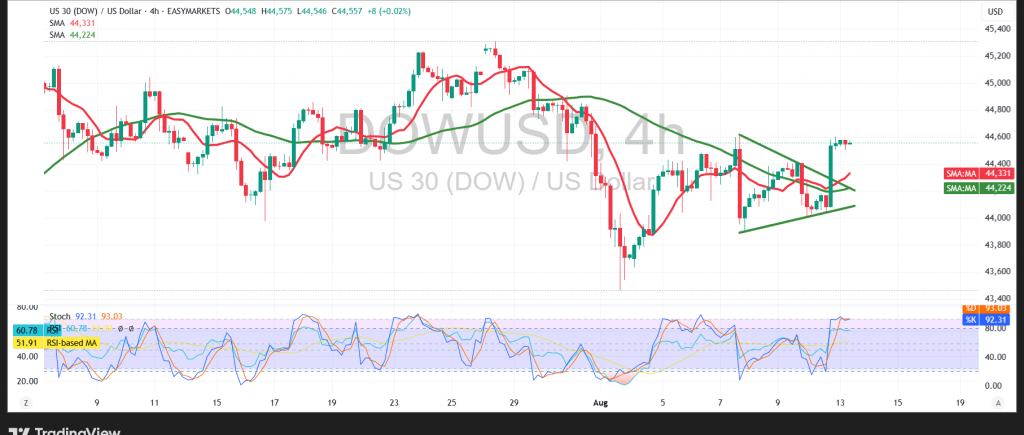

The Dow Jones Industrial Average (DJI30) extended its strong upward momentum on Wall Street, reaching a high of 44,603.

Technical Outlook – 4-hour timeframe:

The index remains firmly positioned above the 50-period simple moving average, reinforcing the likelihood of continued bullish momentum. The Relative Strength Index (RSI) is also providing additional positive signals, supporting the case for further gains.

Likely Scenario:

As long as the price holds above 44,400, the outlook stays positive, with an initial target at 44,620, followed by 44,760 if the 44,650 level is breached. Conversely, a break below 44,400 could trigger selling pressure, sending the index toward 44,290 as the first support, with a deeper decline toward 44,200 possible.

Warning: Risks remain elevated amid ongoing trade and geopolitical tensions, making all scenarios possible.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations