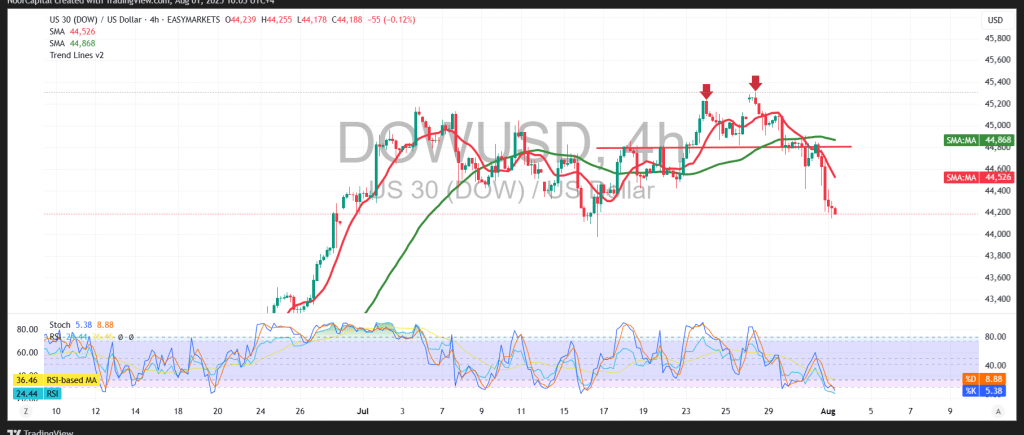

The Dow Jones Industrial Average reversed the previously anticipated bullish scenario after failing to maintain stability above the key support level at 44,485. As highlighted in our last report, a break below this level was expected to expose the index to renewed downside pressure—an expectation that materialized as the index declined to a low of 44,185.

Technical Outlook:

The technical structure continues to favor the bears, with the index trading firmly below the key Simple Moving Averages (SMAs), which now act as dynamic resistance levels. Additionally, the Relative Strength Index (RSI) is generating negative signals, indicating fading bullish momentum and reinforcing the short-term bearish trend.

Probable Scenario:

As long as the index remains below the 44,420 resistance level, the bearish outlook is likely to prevail. A break below the 44,170 support level would likely accelerate downside movement, with targets at 44,075 and then 43,930.

Alternative Scenario:

A confirmed breakout above 44,420 and sustained trading above it may shift the short-term momentum, triggering a corrective recovery toward the 44,645 resistance zone.

Key Risk Events – High Volatility Expected:

Traders should be prepared for elevated market volatility today, with the release of critical U.S. economic data, including:

- Non-Farm Payrolls

- Unemployment Rate

- Average Hourly Earnings

These indicators are likely to significantly influence investor sentiment and index performance.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations