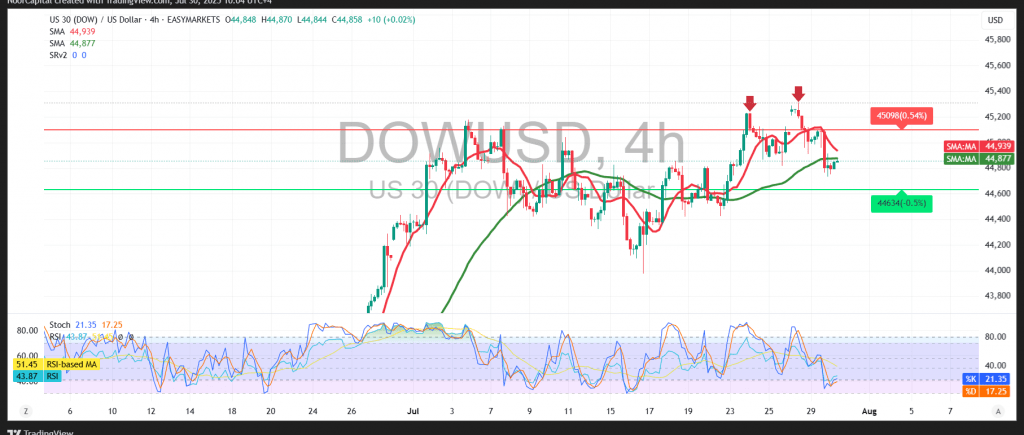

A bearish shift has taken control of the Dow Jones Industrial Average, reversing the upward momentum forecast in our previous report. As noted earlier, sustained trading below the 44,895 level was expected to place the index under renewed selling pressure, with the price reaching a low of 44,735—close to the anticipated support at 44,710.

Technical Outlook:

Technically, the index is now stabilizing below the 50-period Simple Moving Average (SMA), which has re-emerged as a dynamic resistance level, obstructing any immediate bullish attempts. Additionally, the 14-period momentum indicator is beginning to show bearish signals in the short term, reinforcing the negative bias.

Probable Scenario:

As long as the index remains below the 45,000 level, the short-term outlook remains bearish. A continuation of this movement could lead to a test of the 44,730 support area. A break below this level would open the way for a move toward the next key support at 44,690.

Alternative Scenario:

If the price stabilizes above the 45,000 mark, this would provide a technical opportunity for the bullish trend to resume, with initial targets at 45,080 and potentially extending to 45,210.

High-Impact Economic Events – Volatility Expected:

Today’s trading session may witness heightened volatility as investors await a series of high-impact U.S. economic releases, including:

- Non-Farm Payrolls (ADP)

- Quarterly GDP figures

- Federal Reserve interest rate decision

- FOMC statement

- Press conference by Fed Chair Jerome Powell

Warning:

With elevated geopolitical and trade-related uncertainties, the market remains highly sensitive. Risk is elevated, and traders should be prepared for sharp intraday fluctuations and multiple potential scenarios.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations