The Dow Jones Industrial Average opened the week with strong positive momentum, reaching a new high of 44,828 during the first trading session.

Technical Outlook for Today’s Session:

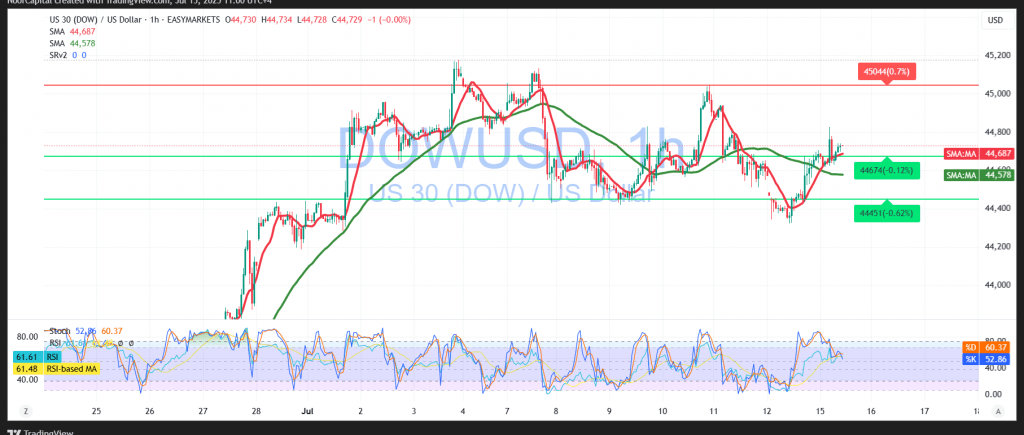

The index is currently attempting to stabilize above minor support at 44,640, with the Relative Strength Index (RSI) showing early positive signals. This suggests that bullish momentum may be sufficient to drive further gains in the short term.

Probable Scenario – Bullish Bias:

If the index holds above 44,640, the path remains open for further upside movement, with 44,930 as the immediate resistance. A breakout above this level could extend gains toward the next target at 45,130.

Alternative Scenario – Bearish Reversal:

Conversely, a confirmed break below 44,640 could shift the bias to the downside, opening the door for a move toward 44,420.

Market Catalyst:

Investors should brace for increased volatility ahead of today’s release of U.S. Core Consumer Price Index (CPI) data (monthly and annual). These figures are highly influential and may trigger strong market reactions.

Caution:

Amid ongoing trade and geopolitical tensions, the risk environment remains elevated. All scenarios remain possible, and traders are advised to implement effective risk management.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations