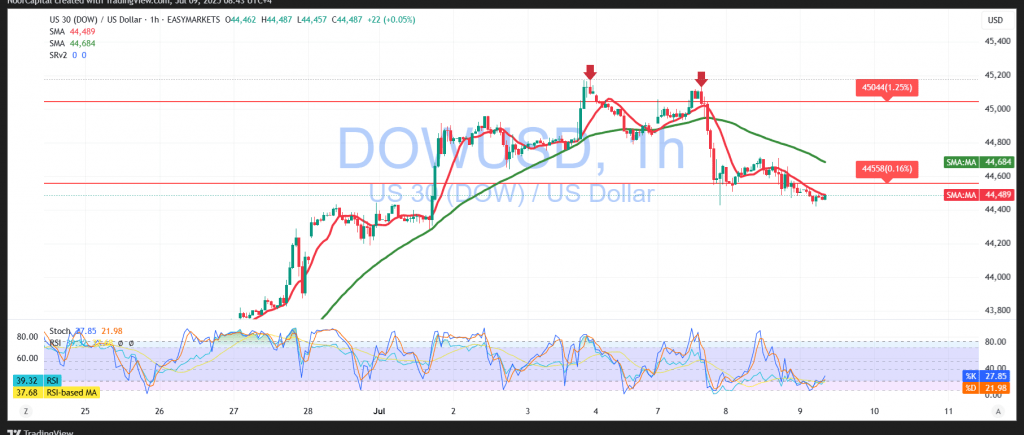

The Dow Jones Index ended the previous trading session with a clear decline, aligning with the bearish scenario outlined in our previous report. The index reached the first expected target at 44,450, recording a session low of 44,420.

Technical Outlook for Today’s Session:

The index maintains a bearish bias, pressured by a negative crossover in the simple moving averages, which are now acting as dynamic resistance. Additionally, the Relative Strength Index (RSI) reflects a noticeable loss of upward momentum, reinforcing the probability of continued downside movement.

Likely Scenario:

Further declines appear likely in the coming hours, with the index expected to target 44,365 as the next support level. A confirmed break below this area could accelerate losses, potentially paving the way for a move toward 44,240.

On the upside, if the index stabilizes and reclaims levels above 44,655, we may see a rebound attempt toward 44,755, with an extended target at 44,830.

Market Catalyst:

Traders should remain cautious ahead of the release of the U.S. Federal Reserve meeting minutes later today. This high-impact event may lead to elevated market volatility.

Caution:

Risk levels remain high due to ongoing global trade and geopolitical tensions. All outcomes are possible, and prudent risk management is strongly advised.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations