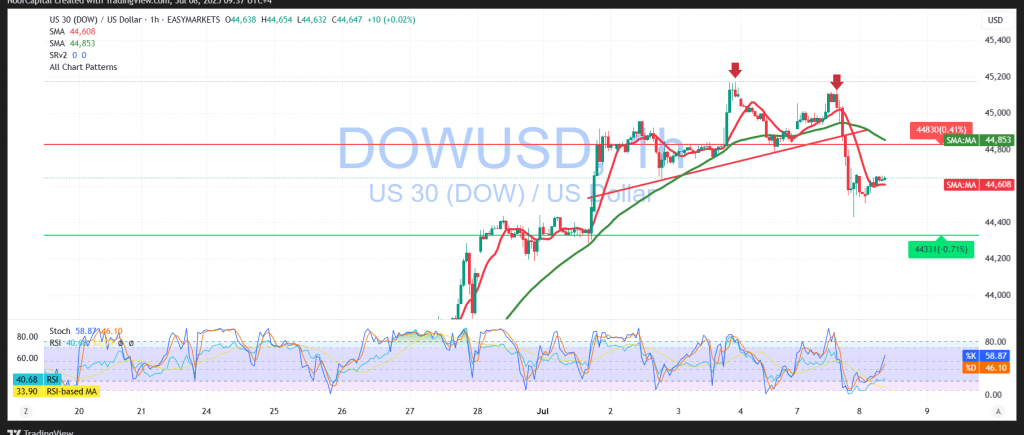

The Dow Jones closed the previous session with a clear loss after reaching a high of 45,132 points and settling at 44,633, reflecting intensified selling pressure.

Technical Outlook

- The index remains under negative pressure, trading below key simple moving averages, which are now acting as dynamic resistance.

- The Relative Strength Index (RSI) is showing signs of waning bullish momentum, reinforcing the probability of additional downside.

Likely Scenario

The short-term trend favors a bearish move, with a likely target at the 44,450 support zone. A clear break of this level could lead to deeper corrections.

Alternative Bullish Scenario

If the index regains strength and establishes stable trading above 44,720, upward momentum may resume, targeting:

- 45,040 as the first resistance

- 45,150 as an extended upside target

Conclusion

Bias leans to the downside as long as the index holds below 44,720. Watch for a potential bounce only if buyers reclaim this level.

Warning

Market risk is elevated due to ongoing trade and geopolitical tensions. Sudden volatility is possible—caution is advised.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations