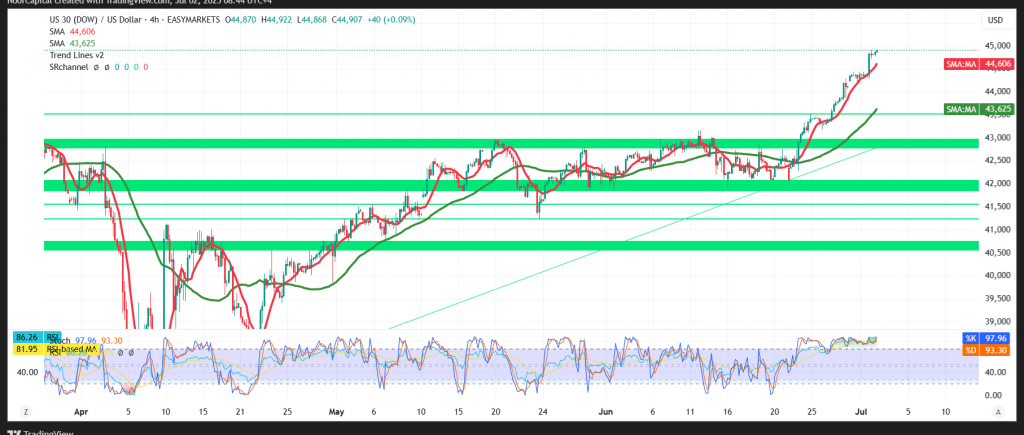

The Dow Jones Industrial Average posted a strong rally on the New York Stock Exchange, registering a new high near 44,920 points, signaling reinforced investor optimism and maintaining momentum in the broader upward trend.

Technical Outlook – Daily Chart:

The index remains stable above 44,922 in early trading, with bullish crossovers in the moving averages acting as dynamic support. Additionally, the Relative Strength Index (RSI) maintains a bullish reading, confirming ongoing buying strength and a firm commitment to the upward path.

Probable Scenario – Continued Bullish Momentum:

If the current momentum holds, the index is likely to pursue further gains, targeting:

- 45,000 as the next immediate resistance

- A confirmed break above this level could lead to extensions towards 45,135, followed by 45,230

Cautionary Note:

- A drop below 44,710 may signal a short-term corrective pullback, with potential downside toward 44,560.

Warning:

The overall risk environment remains elevated due to persistent geopolitical and trade-related uncertainties.

Today’s release of U.S. Non-Farm Payrolls (NFP) data is expected to trigger significant volatility across equity markets.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations