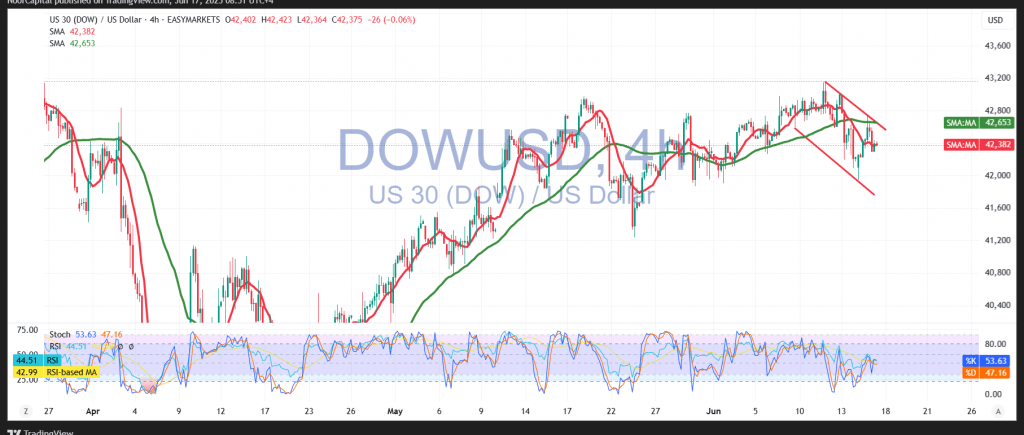

The Dow Jones Industrial Average opened the week positively, breaking above 42,360 and extending its bounce toward the next resistance at 42,485, reaching a session high of 42,745.

From a technical perspective, the simple moving averages are currently acting as resistance from above, while the Relative Strength Index (RSI) is beginning to show bullish signs—suggesting that the recovery may contain further upside momentum.

We are closely monitoring price action for confirmation of one of two scenarios:

- Bullish: A decisive break above 42,500 could propel the index toward the next resistance levels at 42,670 and then 42,750.

- Bearish: Conversely, a breakdown and confirmation below 42,150 may trigger a sharper decline, potentially testing support near 41,930.

Warning: High-impact U.S. retail sales data is due today, which could trigger significant volatility in equities.

Risk: Elevated—global trade and geopolitical uncertainties continue to weigh, and all outcomes remain possible.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations