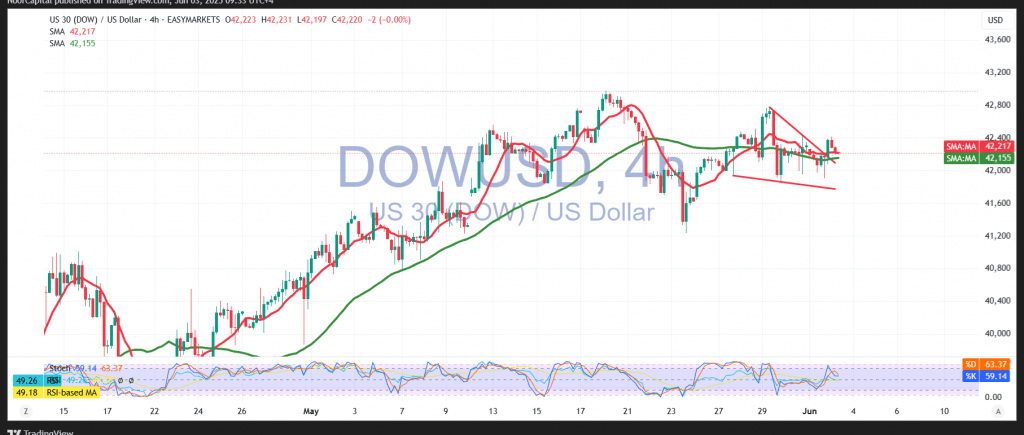

Negative intraday trading is dominating the Dow Jones Industrial Average after the index reached a session high of 42,416 during the previous U.S. session.

From a technical perspective, the simple moving averages are attempting to provide support and limit further declines. However, negative signals are beginning to emerge on the Relative Strength Index (RSI), suggesting weakening momentum. Additionally, intraday trading remains below the minor resistance level at 42,240, which reinforces the near-term bearish outlook.

While the overall bias leans negative, caution is warranted. A clear and sustained break below 42,000 is required to confirm further downside, opening the door to targets at 42,060 and 41,960.

Conversely, a return to stable trading above 42,280 could halt the current downward pressure and allow the index to recover, with the next upside target at 42,460.

Traders should remain cautious, as risk levels remain high amid ongoing trade tensions and global uncertainties. All scenarios remain possible, and market volatility may persist.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations