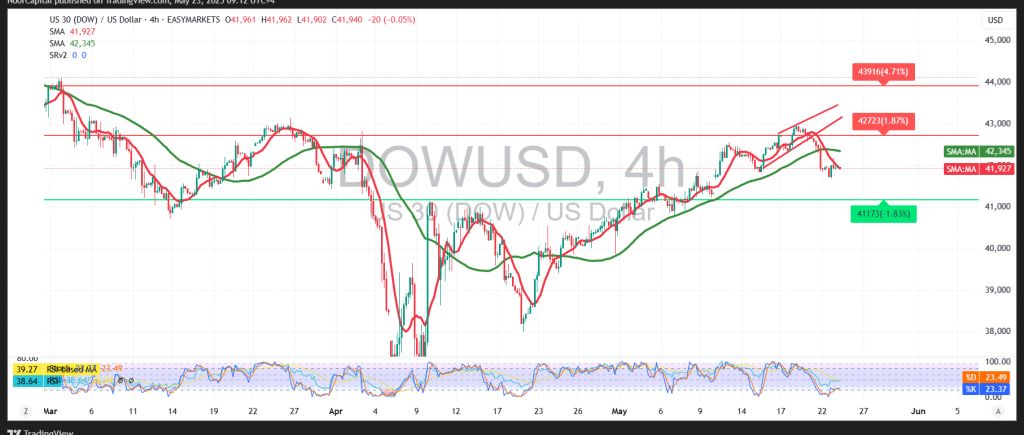

The Dow Jones Industrial Average (DJIA) saw a notable retreat during the latest Wall Street session, aligning with the expected bearish scenario from the previous report. The index gradually declined toward the projected target of 41,620, reaching a session low of 41,696.

From a technical perspective, bearish momentum remains in control. The Relative Strength Index (RSI) continues to trade below the 50 midline, reinforcing negative sentiment. This is further supported by simple moving averages, which are trending downward and acting as key resistance levels.

As long as price action remains below 42,170, the bearish outlook is favored. A confirmed break below 41,690 would likely intensify downside pressure, opening the door to the next support target at 41,450.

On the other hand, a breakout and sustained consolidation above 42,170 would challenge the current downtrend and could prompt a recovery, with initial upside targets at 42,415.

Risk Disclaimer:

Amid ongoing trade tensions and macroeconomic uncertainty, risk levels remain high. Traders should exercise caution and be prepared for increased volatility and multiple potential market outcomes.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations