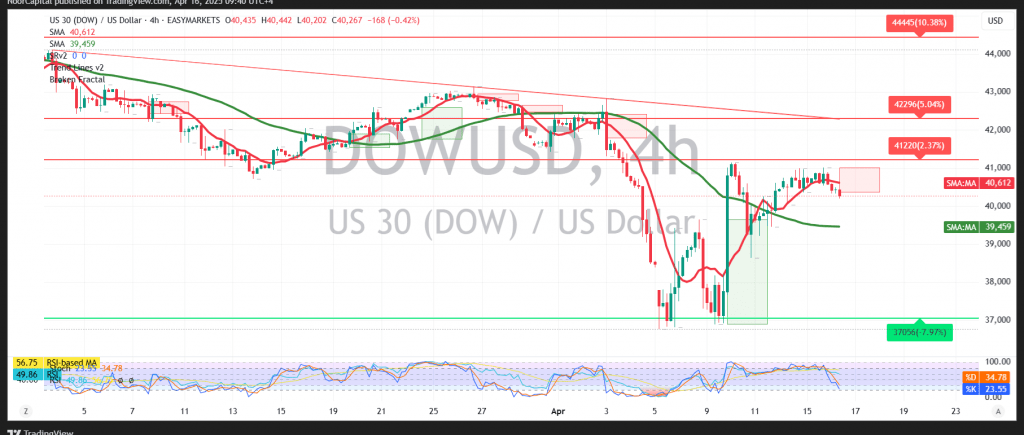

The Dow Jones Industrial Average temporarily gave up recent gains during the previous U.S. trading session after encountering a strong supply zone around the 40,800 level.

From a technical standpoint, the index has resumed a short-term downward correction, influenced by bearish signals from the Relative Strength Index (RSI). However, key simple moving averages continue to provide underlying support, helping to preserve a broadly constructive outlook.

As long as daily trading remains stable above the critical 40,000 level, the bias leans toward a renewed bullish push. A recovery above the 40,800 resistance area would improve sentiment and pave the way for further gains, with upside targets at 41,080 and 41,280.

On the downside, a confirmed break below 40,000 could shift momentum in favor of the bears, potentially triggering a deeper retracement toward 39,940 and 39,665 support zones.

Key Event Risk Today:

Expect potential market volatility tied to major economic announcements, including:

- United States: Retail Sales report and a speech by a Federal Reserve Governor

- Canada: Bank of Canada interest rate decision, monetary policy report, and press conference by the BoC Governor

These events may significantly influence equity market sentiment and direction.

Risk Disclaimer: Given the backdrop of global trade tensions and key central bank decisions, risk remains elevated. Traders should exercise caution and be prepared for volatile intraday moves across a broad price range.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations