The Dow Jones Industrial Average recorded solid gains during the previous U.S. trading session, climbing to a session high of 40,992.

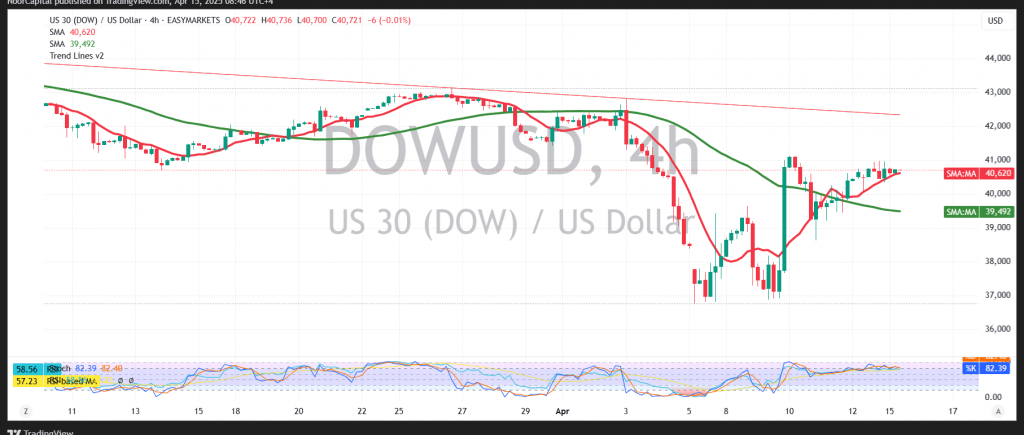

From a technical perspective, the short-term outlook remains bullish but cautious. The Relative Strength Index (RSI) is providing supportive signals on intraday timeframes, and price action continues to hold above the 50-period simple moving average—both reinforcing the potential for continued upside momentum.

As long as intraday trading remains above the key support at 40,265, the bullish scenario remains valid, with the next immediate target seen at 41,140.

However, a confirmed break below 40,265 could disrupt the current upward trajectory, opening the door for a potential retest of the 40,185 support area before any renewed attempt to move higher.

Risk Disclaimer: Given current market conditions and the backdrop of ongoing trade tensions, risk levels remain elevated. Price action may be volatile, and traders should prepare for movement within a broad range of outcomes.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations