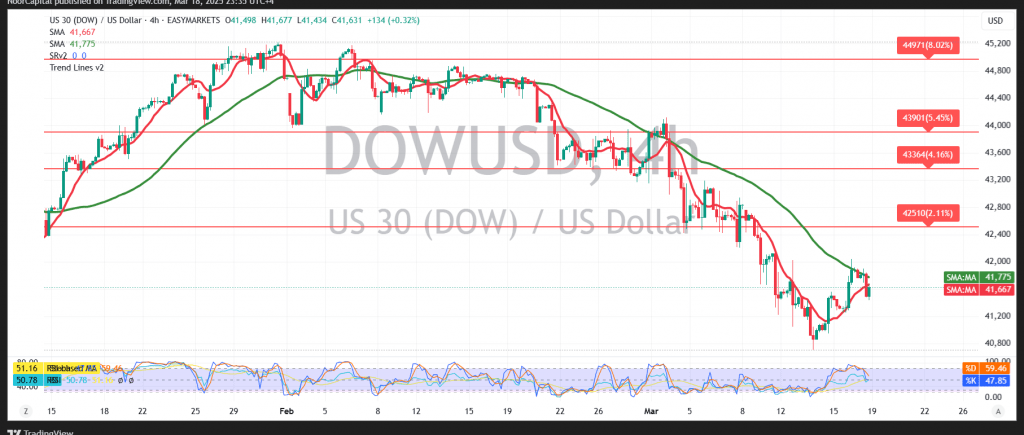

The Dow Jones Industrial Average has experienced a rebound on the New York Stock Exchange following several consecutive sessions of losses, with a recent low around 40,708.

From a technical perspective, the outlook remains tilted toward the downside. While the index has made some recovery attempts, upward momentum appears limited, as the simple moving average continues to act as a resistance barrier.

As long as the index remains below 42,045, the likelihood of a continued downtrend increases. A break below 41,440 could accelerate declines toward 41,250 and possibly 40,860.

Conversely, a confirmed breakout above 42,045, accompanied by an hourly candle close above this level, could signal a partial recovery, with the index likely to retest resistance at 42,440.

Market volatility is expected to be high today due to key U.S. economic events, including the Federal Interest Rate Decision, Federal Reserve Statement, Federal Reserve Chairman’s Press Conference, and the Federal Reserve Economic Outlook. These events could significantly impact price movements.

With prevailing economic uncertainties, risks remain elevated, and multiple scenarios are possible.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations