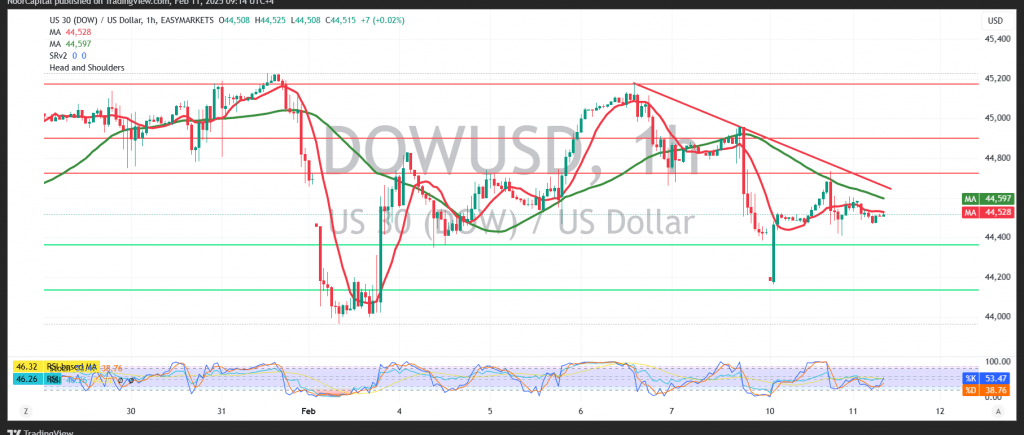

The Dow Jones Industrial Average (DJIA) experienced mixed trading at the start of the week, reaching a low of 44,410.

Technical Outlook:

- Supportive Factors:

- Simple moving averages continue to provide a positive stimulus.

- Bearish Indicators:

- The Stochastic indicator shows weakening upward momentum.

- The Relative Strength Index (RSI) on short-term time frames signals negative pressure.

Key Levels to Watch:

- Bearish Scenario:

- Stability below 44,540 and especially under 44,640 may trigger a move toward 44,375.

- A break below 44,375 could accelerate the decline toward 44,230.

- Bullish Scenario:

- A break above 44,640 would weaken the bearish outlook, potentially leading to upside corrections.

Market Risks & Considerations:

- Jerome Powell’s testimony today may drive high volatility in DJIA movements.

- Ongoing trade tensions add to market uncertainty.

⚠ Risk Warning: Given current conditions, market movements may be unpredictable, and all scenarios remain possible.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations