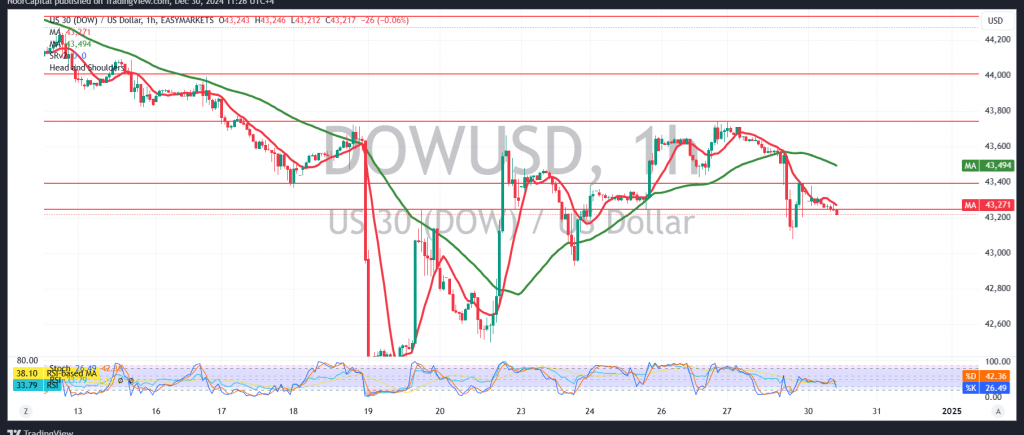

The Dow Jones Industrial Average (DJIA) continued its bearish momentum during the previous trading session, reaching a low of 43077.

Technical Analysis:

- The 50-day simple moving average exerts downward pressure, aligning with the bearish trend.

- The Relative Strength Index (RSI) is providing negative signals on short-term timeframes, further supporting the bearish outlook.

Expected Scenarios:

Bearish Scenario (Preferred):

- Stability below the 43470 resistance level reinforces the likelihood of a downward move.

- Initial targets include 42990, with a break of this level likely extending losses towards 42745.

Bullish Scenario (Alternative):

- A break above the 43470 resistance level could invalidate the bearish scenario.

- In such a case, the index may attempt to recover with targets at 43700 and higher.

Caution:

Elevated risk persists due to geopolitical tensions, with potential for high market volatility.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations