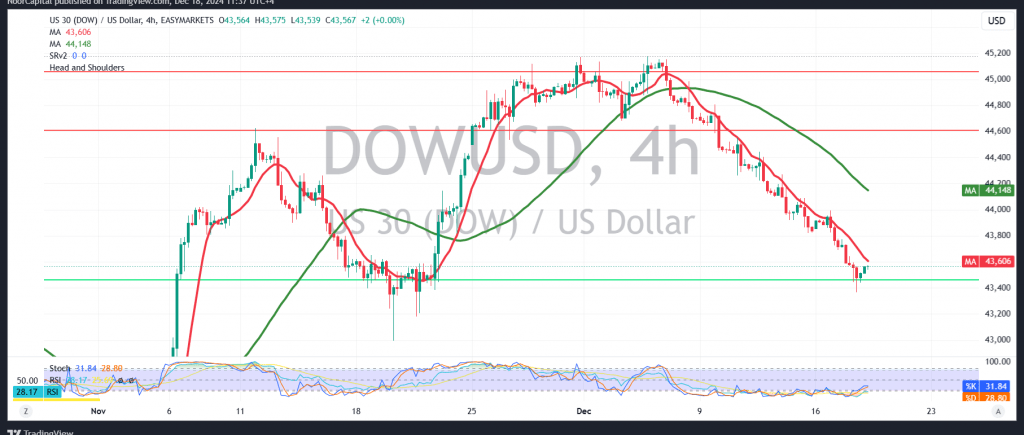

The Dow Jones Industrial Average maintained a strong downward trend during the previous session, reaching a low of 43,370.

From a technical perspective today, while conditions still favor the possibility of a decline, an upward correction is anticipated, aligned with the RSI’s attempt to generate positive signals that could enable temporary gains.

If intraday trading stabilizes above 43,760, there may be an opportunity to retest 43,745, and breaking this level could open the way toward 43,930. It’s important to note that this temporary rise remains consistent with the broader downward trend. However, a break below 43,370 could invalidate the bullish correction scenario, pushing the index toward 43,190.

Alert: High-impact U.S. economic data, including the interest rate decision, Federal Reserve statement, economic projections, and the Fed Chair’s press conference, is expected today, which may lead to heightened price volatility.

Warning: Elevated risks persist due to ongoing geopolitical tensions, and all scenarios remain possible.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations