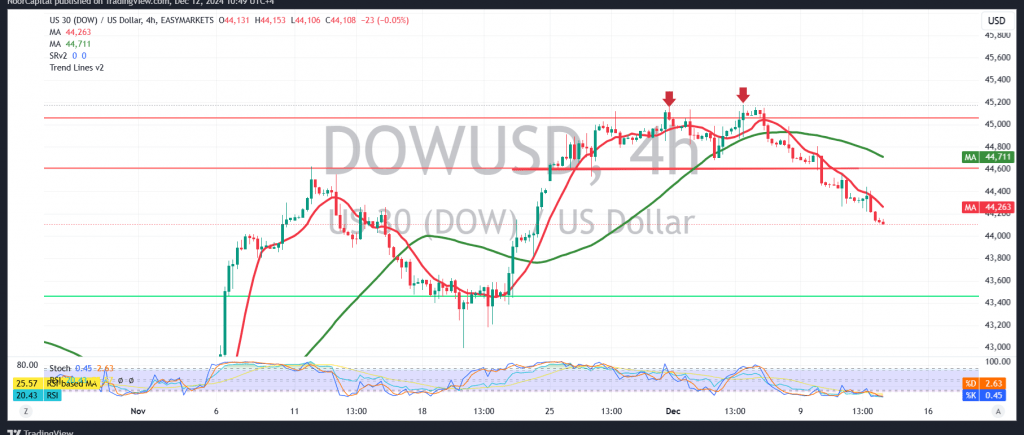

The Dow Jones Industrial Average remained neutral in line with the previous technical report, where conflicting technical signals led to cautious analysis. The anticipated break of 44,230 extended losses, with the index marking a low of 44,113.

Technical Analysis

- Current Indicators:

- The Relative Strength Index (RSI) continues to signal bearish momentum.

- The simple moving averages exhibit a negative crossover, reinforcing the downward bias.

- Key Levels to Monitor:

- Downside:

- Stability below the 44,340 resistance level supports the bearish outlook.

- The primary target remains 44,005, with a potential extension to 43,890 if this level is breached.

- Upside:

- Recovery above 44,340 may negate the bearish scenario, necessitating a reassessment of the trend.

- Downside:

Key Events to Watch

- European Economy: ECB monetary policy statement, interest rate announcements, and press conference.

- U.S. Economy: Monthly and annual Producer Price Index figures and unemployment benefits data.

These announcements are expected to introduce heightened price volatility.

Warnings

Trader Advisory: Caution is essential due to heightened market sensitivity from geopolitical and economic developments.

Risk Levels: Elevated risks persist, with potential returns not aligned with the prevailing uncertainty.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations