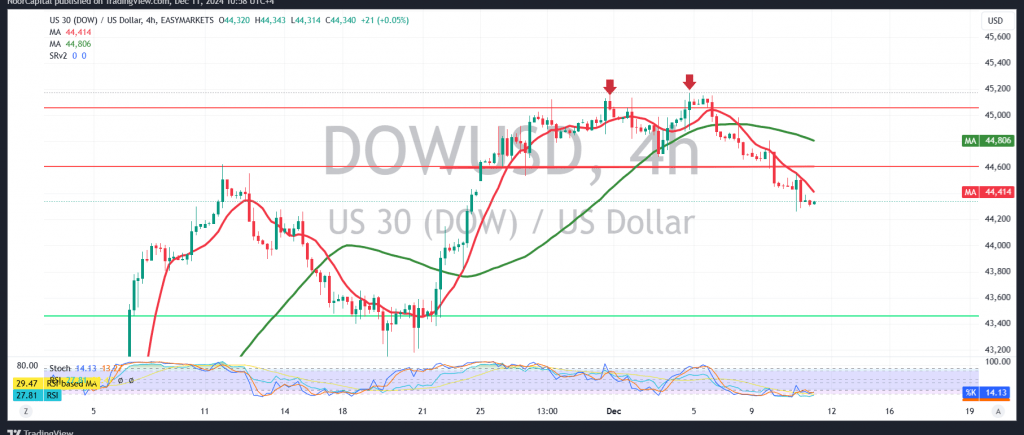

The Dow Jones Industrial Average maintained its bearish trajectory, aligning with the negative outlook outlined in the previous analysis, hitting the first target of 44,340 and nearing the second target of 44,200, with a low of 44,263.

Technical Analysis

A closer examination of the 4-hour chart reveals conflicting signals:

- Bearish Factors: The simple moving averages continue to apply downward pressure, suggesting further declines.

- Bullish Factors: The Stochastic indicator is hovering in overbought areas, signaling a potential upward correction.

Trading Scenarios

Given the mixed signals, price action will determine the next move:

- Bearish Continuation:

- Key Levels: Sustained trading below 44,520 and, more importantly, 44,570 is required.

- Breakout Condition: A clear breach of 44,230 would pave the way for further losses, targeting 44,095 and 43,930.

- Bullish Reversal:

- Key Levels: Breaching 44,570 would signal recovery.

- Targets: Initial upward targets are 44,675 and 44,790.

Key Events

The release of the U.S. “Annual Consumer Price Index” and “Monthly Consumer Price Index” today could result in heightened market volatility.

Warnings & Alerts:

Price volatility may not correspond with expected returns; careful monitoring is essential during trading.

Elevated risk levels due to geopolitical tensions and economic data uncertainties.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations