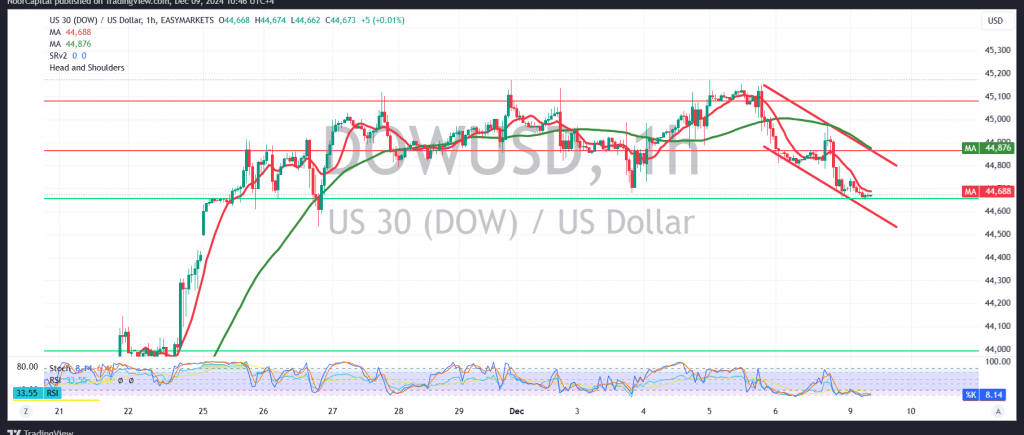

The Dow Jones Industrial Average is experiencing a bearish trend in intraday movements following several consecutive sessions of gains, with current activity stabilizing near the session’s low around 44660.

Technically, today’s outlook suggests the likelihood of a bearish trend driven by negative pressure from the simple moving averages and reinforced by bearish signals from the 14-day momentum indicator.

With trading remaining below the pivotal resistance level at 44880, the bearish scenario is favored, targeting 44560 as the initial level. Breaching this level would enhance and accelerate the bearish momentum, with expectations to reach 44445 as the next target.

On the other hand, consolidation above 44880 would negate the bearish scenario, paving the way for recovery towards 45090 and subsequently 45250.

Warning: The risk level may be high and not aligned with the expected return, necessitating cautious assessment. Warning: The risk level is high amidst ongoing geopolitical tensions, and all scenarios remain possible.

Risk Management:

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations