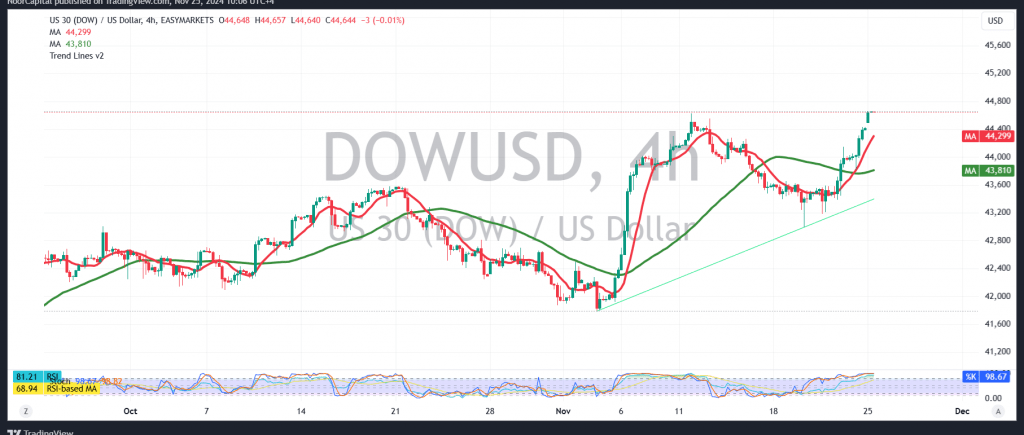

The Dow Jones Industrial Average started the week with significant gains, opening with an upward price gap and reaching a high of 44,661.

From a technical perspective, the index showed a strong upward rebound, supported by positive momentum from the 50-day simple moving average and clear bullish signals from the RSI on short-term charts.

These factors suggest the potential for further gains, with a break above 44,655 likely to accelerate the bullish trend, paving the way toward targets at 44,935 and possibly extending to 45,220.

However, a sustained move back below the support level of 44,090 would invalidate this outlook, exposing the index to renewed downward pressure, with a potential target at 43,530.

Warning: The risk level is elevated and may not align with the expected returns. Ongoing geopolitical tensions add to the uncertainty, making all scenarios plausible.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations