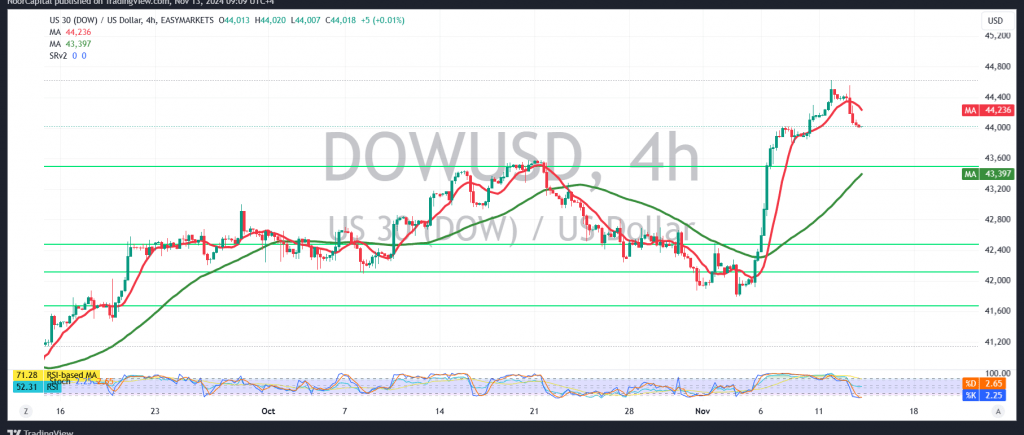

The Dow Jones Industrial Average reversed from the previously anticipated upward trend highlighted in our last technical report. Our outlook had depended on the index maintaining stability above 44,260, but a breach below this level shifted the momentum, resulting in a retest of 44,160 and 44,090, with the index ultimately reaching a low of 44,004, nullifying the previous buying stance.

Technically, our outlook has now turned cautiously bearish. This shift is supported by the index’s failure to break back above the now-resistance level of 44,260, along with bearish signals from the Relative Strength Index on shorter timeframes.

As a result, we may see a continuation of the downward trend in the coming hours, with initial targets at 43,850 and 43,830. However, if the index manages to reclaim and stabilize above 44,260, it could pave the way for a recovery towards 44,375.

Caution: The risk level is elevated and may not be proportionate to the potential return, so careful assessment is necessary.

Risk Alert: High-impact economic data from the US, specifically the “Consumer Price Index – Annual and Monthly,” is expected today, which could result in significant market volatility.

Geopolitical Risk Warning: Given the ongoing geopolitical uncertainties, the market remains exposed to various unpredictable scenarios.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations