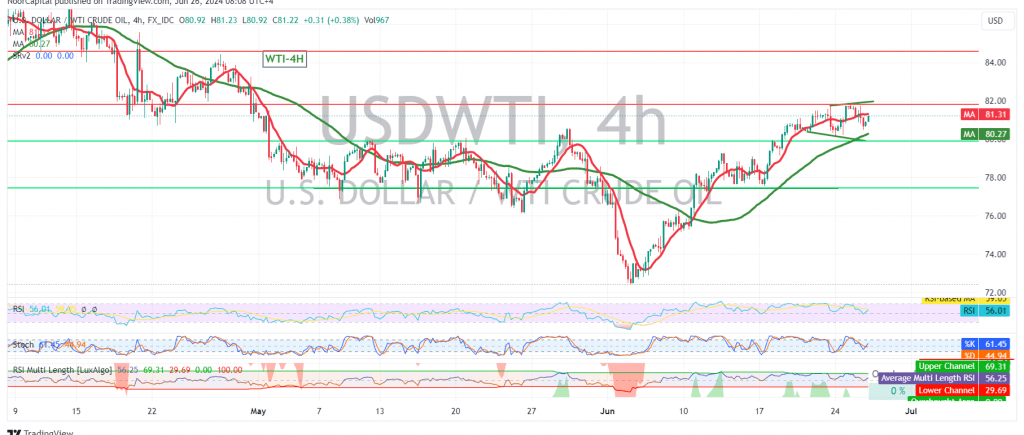

US crude oil futures prices experienced a pullback after several days of gains, failing to hold above the 81.50 resistance level and retesting the 80.60 support level.

Technical Outlook:

Despite the recent decline, the technical outlook remains cautiously bullish. The price is currently attempting to rebound and retest the 81.50 level. The 50-day simple moving average continues to provide support, and the price remains above the 80.60 support level.

Upward Potential:

A breakout above the 81.50 resistance level is crucial for the continuation of the bullish trend. If this level is breached, we could see further gains towards 81.80 and 82.45, with the potential for an extended rally towards 82.90.

Downside Risks:

However, if the price fails to break above 81.50 and instead falls below 80.60, the bullish scenario would be invalidated. In this case, we could expect a temporary correction with an initial target of 79.95.

Key Levels:

- Support: 80.60, 79.95

- Resistance: 81.50, 81.80, 82.45, 82.90

Important Note:

The risk level remains high in this market, and traders should exercise caution. The ongoing geopolitical tensions could contribute to increased price volatility.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for WTI crude oil.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations