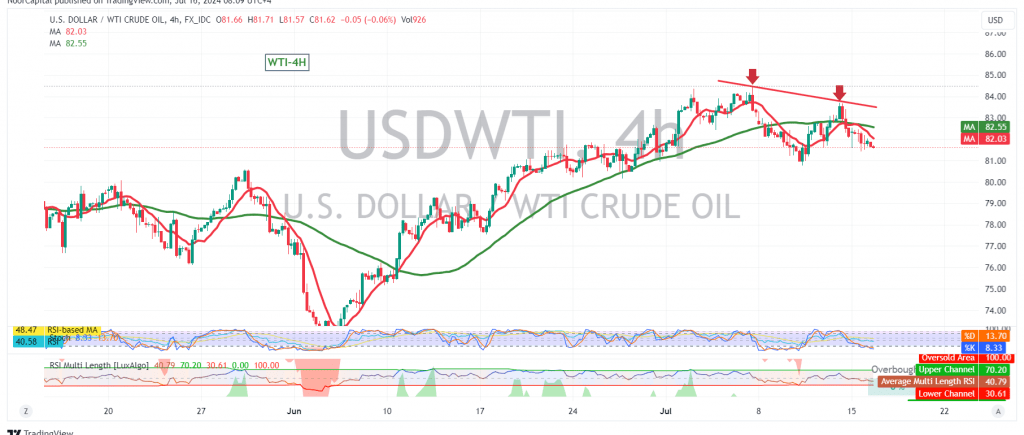

US crude oil futures prices declined after encountering resistance at the 84.00 psychological level, indicating a potential shift in momentum.

Technical Outlook:

The current technical outlook is bearish. The price is now trading below the 82.00 support level on the 4-hour chart. The simple moving averages (SMAs) have formed a negative crossover, and the momentum indicators are showing negative signals, further reinforcing the bearish bias.

Downside Potential:

Given these factors, the downward trend is likely to continue, with an initial target of 81.25. If this level is breached, further declines towards 80.80 and 80.20 are possible.

Potential Reversal:

Traders should be aware that a return of trading stability above 82.40 could invalidate the bearish scenario. In this case, we may witness a recovery towards 83.00 and potentially 83.40.

Key Levels:

- Resistance: 82.40, 83.00, 83.40

- Support: 82.00, 81.25, 80.80, 80.20

Important Note:

The release of high-impact U.S. economic data today, including monthly retail sales and core retail sales excluding cars, could induce significant price volatility. Traders should closely monitor the market’s reaction to these data releases.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for WTI crude oil.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations