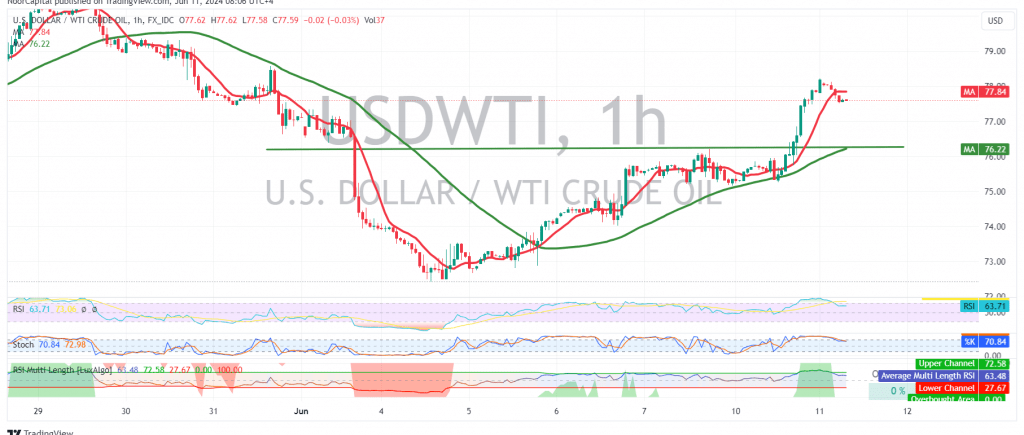

WTI crude oil prices rebounded during the previous session, finding support at the pivotal 75.25 level we highlighted in our prior report. A break below this level would have signaled a continuation of the downward trend.

On the 240-minute chart, we now observe positive crossover signals from the simple moving averages, indicating potential bullish momentum. This is further supported by clear positive signals on the Relative Strength Index (RSI) and the price’s ability to hold above the 77.20 resistance level.

Based on these technical indicators, a shift to an upward trend is possible, with an initial target of 78.80. A break above this level would pave the way for further gains towards 79.90, and potentially even 80.50.

However, it’s crucial to note that this bullish scenario hinges on the price remaining above the strong support level of 75.85. A break below this level could reignite the downward trend, with targets starting at 74.10.

Key Points:

- WTI crude oil is showing signs of a potential bullish reversal.

- The 75.85 level is a critical support to monitor.

- Traders should consider long positions with caution, setting appropriate stop-loss orders.

- Given the inherent volatility of the oil market, risk levels remain elevated.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for WTI crude oil.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations