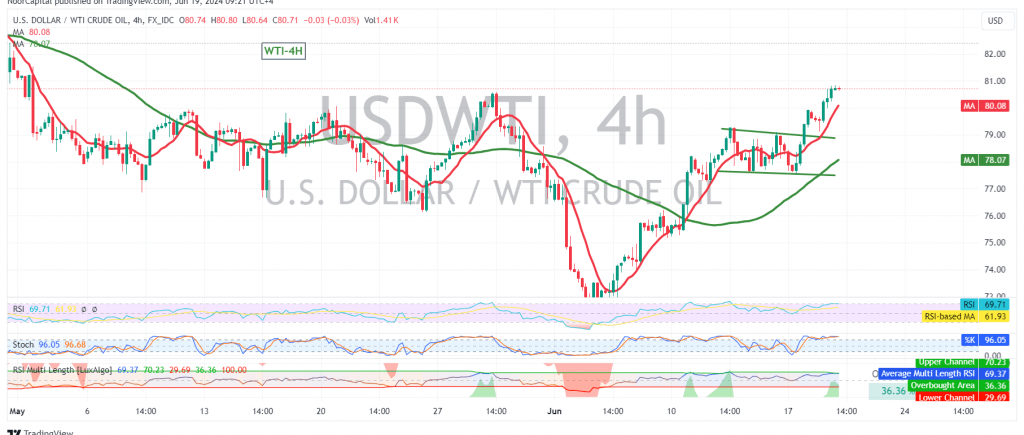

WTI crude oil futures prices continue their upward trajectory, approaching our previously identified target of 81.30 and reaching a high of $81.13 per barrel.

Technical Outlook:

While the intraday movement shows some consolidation below 81.00, the overall trend remains bullish. The Stochastic indicator on the 4-hour chart is hinting at potential further upside momentum, suggesting that the rise may continue.

Upward Potential:

As long as trading remains above 80.10, the bullish bias is favored. The initial target is 81.00, and a break above this level could pave the way for the remaining targets of our previous report at 81.50 and 81.90.

Downside Risks:

However, traders should remain cautious as a break below the 80.00 support level could trigger a reversal, leading to downward pressure with a target of 79.30.

Key Levels:

- Support: 80.10, 79.30

- Resistance: 81.00, 81.30, 81.50, 81.90

Important Note:

The release of high-impact economic data today, including the interest rate decision and unemployment benefits data, could induce significant price volatility. Additionally, ongoing geopolitical tensions further elevate the risk level, potentially resulting in sharp price fluctuations.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for WTI crude oil.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations