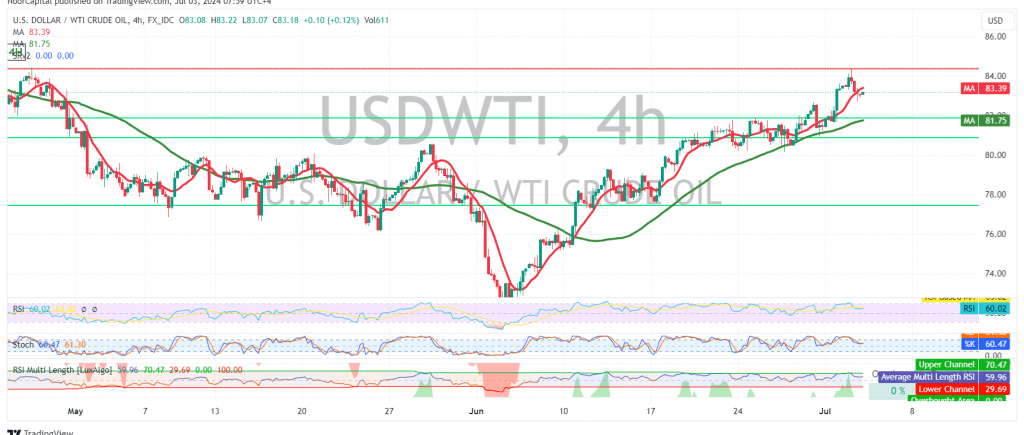

US crude oil futures prices reached our previously identified target of 84.20, peaking at $84.35 per barrel, before experiencing a slight pullback to retest the 83.00 level.

Technical Outlook:

Despite the recent correction, the technical outlook remains bullish. The 240-minute chart reveals that the simple moving averages (SMAs) are still providing support for the upward price movement, encouraging us to maintain our positive expectations.

Upward Potential:

The upward trend is likely to continue, provided that the price breaks above the 83.90 resistance level. This would pave the way for a move towards 85.00, followed by 85.70.

Downside Risks:

However, traders should remain cautious as a failure to consolidate above 82.50 could lead to a temporary correction, potentially targeting 80.90.

Key Levels:

- Support: 82.50, 80.90

- Resistance: 83.90, 85.00, 85.70

Important Note:

The release of the U.S. ADP Non-Farm Employment Change report today could induce significant price volatility. Traders are advised to closely monitor the market’s reaction to this high-impact economic data.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for WTI crude oil.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations