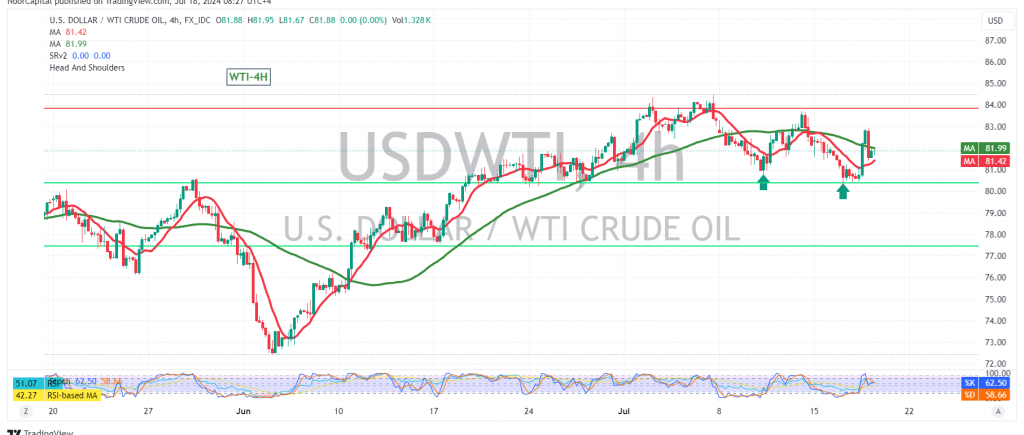

WTI crude oil futures prices rebounded yesterday, finding support at the 80.50 level and closing above the 81.80 resistance level, indicating a potential resumption of the bullish trend.

Technical Outlook:

Today’s technical analysis suggests a positive outlook for WTI crude oil. The price is holding above 81.80, with the 14-day momentum indicator showing clear positive signals. Additionally, the price has reclaimed its position above the 50-day simple moving average, further reinforcing the bullish bias.

Upward Potential:

With the current bullish momentum and the price holding above key levels, we anticipate further upward movement. The initial target is 83.00, and a break above this level could open the door for a rally towards 84.00.

Downside Risks:

However, traders should remain cautious as a break below 81.80 on the hourly chart could invalidate the bullish scenario and trigger a correction, targeting 80.65 and 80.00.

Key Levels:

- Support: 81.80, 80.65, 80.00

- Resistance: 83.00, 84.00

Important Note:

The release of high-impact economic data from the European Central Bank today, including the interest rate decision and the press conference, could induce significant price volatility. Traders should closely monitor the market’s reaction to these announcements.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. The risk level remains high in this market, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations