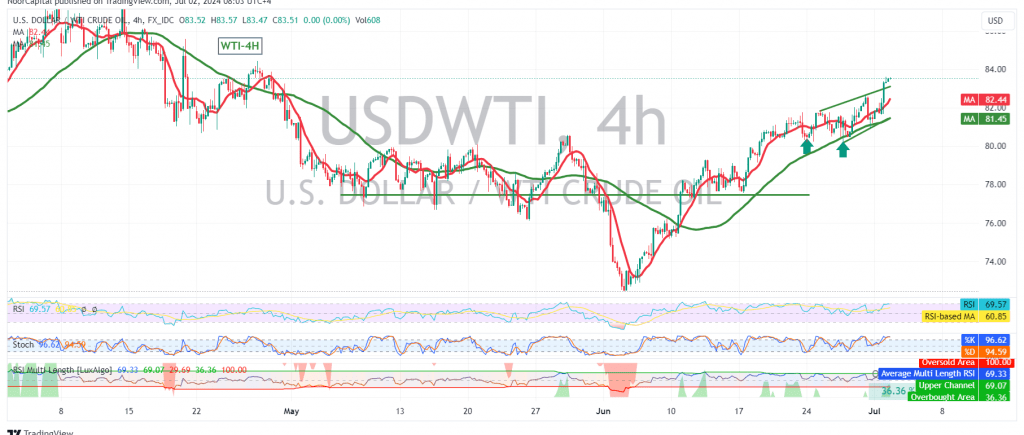

WTI crude oil futures prices surged yesterday, marking the third consecutive week of gains and reaching our previously identified target of 82.90, ultimately peaking at $83.60 per barrel.

Technical Outlook:

The technical outlook remains strongly bullish. The 4-hour chart reveals continued support from the simple moving averages (SMAs) for the upward price movement, and a solid support base has formed around the 82.00 level.

Upward Potential:

A break above the 83.60 level would likely accelerate the upward trend, with the potential for the price to reach 84.25 as the next target, followed by 85.00.

Downside Risks:

Traders should remain cautious, however, as a failure to consolidate above 82.00 could trigger a temporary pullback to 80.70.

Key Levels:

- Support: 82.00, 80.70

- Resistance: 83.60, 84.25, 85.00

Important Note:

The release of high-impact U.S. economic data today, including job vacancies and labor turnover rate, along with a speech by the Federal Reserve Chairman, could induce significant price volatility. Traders should exercise caution and closely monitor the market’s reaction to these news releases.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for WTI crude oil.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations