US crude oil futures prices experienced a significant decline in the previous trading session, reaching a low of $77.60 per barrel.

Technical Outlook:

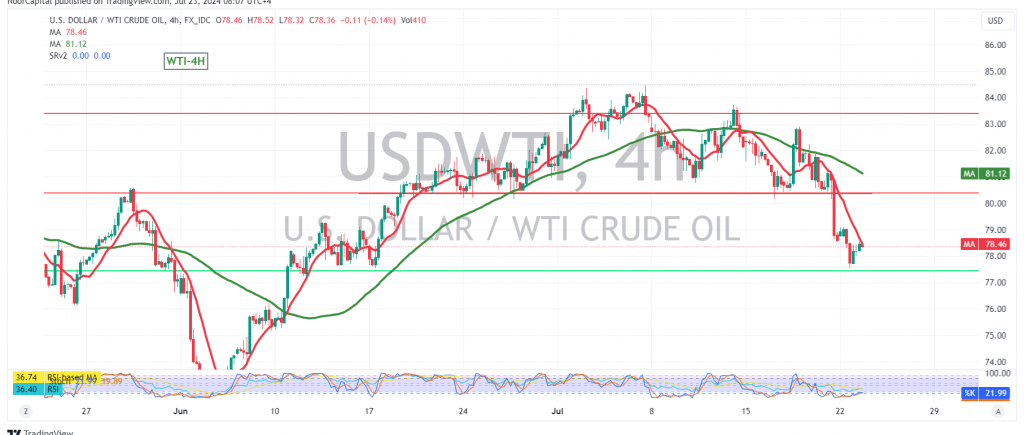

The technical outlook has shifted to a bearish bias. The simple moving averages (SMAs) are now supporting the current downward wave, and the Relative Strength Index (RSI) is displaying clear negative signals on short time intervals, confirming the bearish momentum.

Downside Potential:

With the price trading below the 79.00 psychological resistance level, the downward trend is likely to continue. The initial target is 77.60, and a break below this level would further strengthen the bearish momentum, paving the way for a move towards 76.85.

Potential Reversal:

Traders should be aware that a break above 79.00, and more importantly, a consolidation above 79.10, could invalidate the bearish scenario. In this case, we may witness a recovery towards 79.85 and 80.40.

Key Levels:

- Resistance: 79.00, 79.10, 79.85, 80.40

- Support: 77.60, 76.85

Important Note:

The risk level remains high in this market due to ongoing geopolitical tensions and potential price volatility. Traders are advised to exercise caution and closely monitor market developments.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. The risk level remains high in this market, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations