The Eurozone’s recovery from the recent downturn is largely due to the growth of the service sector, which has seen job creation accelerate. However, the region faces challenges in meeting the European Central Bank’s 2% target due to persistently high service prices driven by wages.

The EU’s decision to stop importing Russian natural gas and Russia’s invasion of Ukraine caused a price shock that led to inflation decelerating to 2.4% last month. Business activity in the Eurozone expanded at its fastest rate in almost a year in April, indicating recovery from the downturn.

However, persistently high pricing pressures in the service sector have exacerbated these pressures. Germany entered growth territory for the first time in ten months as the manufacturing slowdown subsided, while France’s output was only slightly down. The rest of the region did the best, with output rising for a fourth consecutive month in April due to strong growth in the service sector and almost constant manufacturing output.

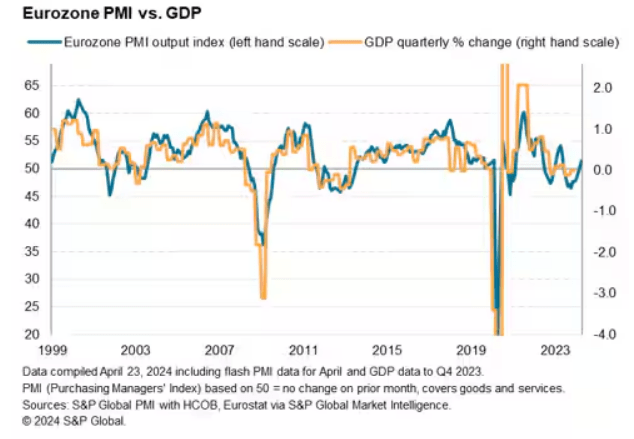

The HCOB Flash Eurozone Composite PMI Output Index increased from 50.3 in March to 51.4 in April, indicating a second consecutive month of rising output. The GDP of the eurozone is expected to have grown at a quarterly pace of 0.1% in April, an improvement over the 0.1% loss indicated for Q1.

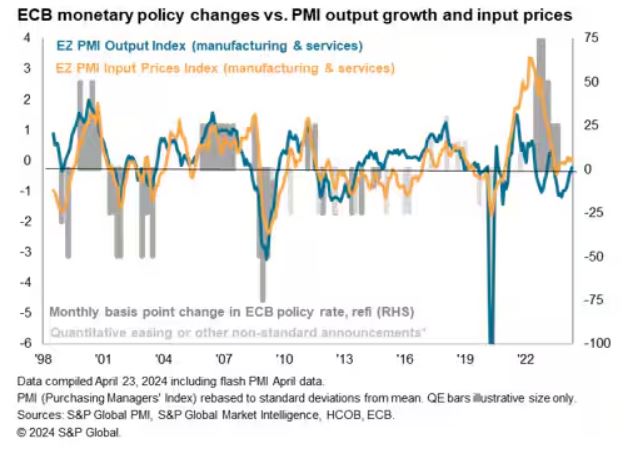

In April, the average cost of inputs for both goods and services sectors reaccelerated, marking the fastest growth in the preceding 12 months. Although the price of manufacturing inputs was down, it was the least during the previous 14 months. The rate of inflation for services sector costs increased, with businesses often citing rising wage rates, combined with rising energy and fuel expenses, as major contributors to inflation.

Business forecasts for the upcoming 12 months are cooling slightly from March, but they remain the second-highest level in the last 14 months, indicating growing convergence. Business confidence has increased in recent months due to reduced interest rates, a lessening pinch on living expenses, indications of reviving corporate and household demand, and a more supportive global inventory cycle for demand.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations