The previous few weeks have seen a turbulent ride for cryptocurrencies, with unexpected lows and tremendous highs. Nevertheless, new information indicates that Ethereum and Bitcoin may be quietly making a comeback, even though their ascent may not be as high as initially anticipated.

Current Trends in Prices

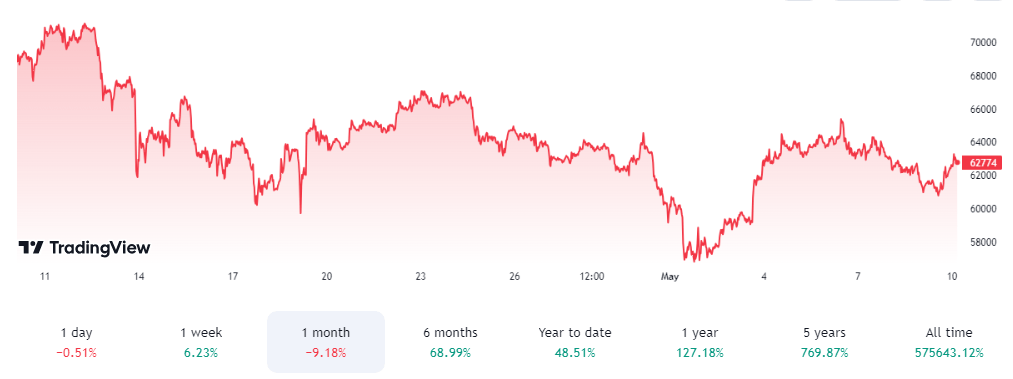

After three days of losses, Bitcoin, the first and biggest cryptocurrency by market capitalization, dropped to intraday lows of $60,601. Although price is still underperforming in comparison to Bitcoin’s tickers down $62,754 2024 advances, analysts speculate that better times may be on the horizon. Ether’s underperformance in terms of price could be caused by a weaker capital rotation.

Over the past two years, Ether has underperformed Bitcoin, which has led to a poorer ETH/BTC ratio. On May 1, the ratio dropped to $0.04622, the lowest level since April 2021. The majority of significant traders and investors have recently focused on Ethereum. Because of the volatility and unpredictability in the larger cryptocurrency market, Ethereum’s chart has been showing some exciting action.

After three days of losses, Ethereum’s price behaviour followed that of Bitcoin, which also saw intraday lows. On the ETH price chart, some observers have detected a pattern that looks like a flag. Flags are continuation patterns that frequently show up during short breaks in trends that are either bullish or bearish. The pattern may not meet the traditional definition of a flag because of its length. Rather, it has the appearance of a channel—a formation that is managed by two sloping, parallel lines. These lines are tested twice or more by price action.

The crypto world is once again plagued by ambiguity because both patterns—whether they are flags or channels—indicate the possibility of a breakout in either direction, either upward or downward. It is reasonable to say that Ethereum’s chart offers traders and investors an intriguing riddle, and that their upcoming price moves need to be carefully considered and studied.

Interconnected Movement:

Because investors see Bitcoin and Ethereum as interchangeable, they frequently move in tandem. Their association is further strengthened by the fact that many Initial Coin Offerings (ICOs) are priced in either Bitcoin or Ethereum. A number of factors, such as supply and demand, affect the price of bitcoin because scarcity is a key component in its pricing. Price changes can be influenced by market sentiment.

Regulation clarity or uncertainty affects the cryptocurrency market as a whole. Of course, investor behaviour is influenced by the state of the world economy. Regarding Ethereum’s distinctive features, its price is affected by platform updates, such as enhancements and modifications to the Ethereum network. Because of Ethereum’s prominence in decentralized finance (DeFi) applications, its accumulation frequently makes news headlines.

The need for blockspace is growing as more Ethereum-based projects are developed. The performance of technology stocks, macroeconomic variables, and the US dollar’s strength all have an impact on both assets.

Regulatory Uncertainty:

There is still regulatory uncertainty despite advancements. The Securities and Exchange Commission’s (SEC) approval of spot Bitcoin ETFs is in contrast to the delay in the approval of spot Ethereum ETFs. Price setbacks can result from such uncertainty.

Mainstream Adoption:

Although more people are becoming aware of cryptocurrencies, the percentage of regular users who do so is still quite low. This cautious attitude is influenced by concerns regarding regulatory clarity and the state of the economy.

Ethereum’s Prospects:

Because of its strong ecosystem, smart contract capabilities, and DeFi dominance, Ethereum has a bright future. Long-term performance may surpass Bitcoin, according to some analysts. However, given Bitcoin’s first-mover advantage and broad reputation, surpassing its price is still doubtful.

With none of the fanfare of past years, Bitcoin and Ethereum are both quietly returning. Investors ought to use caution when dealing with these assets and consult a financial advisor before taking any action1. It will be essential to monitor regulatory changes and adoption patterns as the cryptocurrency sector develops to comprehend its future course.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations