In a week marked by pivotal decisions from five of the world’s largest central banks, including the US Federal Reserve and the Bank of Japan, all eyes are now turning to the Bank of England’s upcoming announcement scheduled for Thursday. Speculation abounds regarding the likelihood of a maintained interest rate at 5.25%, amidst a contentious debate over the timing of potential policy adjustments, particularly regarding ongoing quantitative tightening measures.

While both the European Central Bank and the US Federal Reserve are anticipated to implement interest rate reductions by June, financial analysts suggest that the Bank of England may opt for a more cautious approach, potentially delaying any policy shifts until August.

During its inaugural meeting of 2024, the Bank of England upheld its key interest rate at 5.25%, marking the fourth consecutive instance of maintaining this level – a decision widely anticipated by the market.

The central bank elucidated its stance, emphasizing the necessity for sustained tight monetary policy to facilitate the gradual return of inflation to the targeted 2% threshold over the medium term. Notably, it acknowledged that inflation risks are exhibiting a more balanced trajectory.

However, following the release of official data today indicating a more significant decline in Britain’s inflation rate than initially forecasted, speculation mounts regarding a potential alteration in the Bank of England’s stance. Could it align itself with its global counterparts and initiate an interest rate reduction by June?

As anticipation builds towards the Bank of England’s imminent announcement, market participants are poised to decipher the implications of any policy shifts, closely monitoring the central bank’s response to evolving economic dynamics and inflationary pressures.

Earlier, the British Bureau of Statistics revealed a notable decline in the country’s inflation rate, which dropped to 3.4% on an annual basis in February 2024. This marked a decrease from the 4% recorded in both January and December of the previous year.

The reported index reading contradicted market expectations, settling below the anticipated 3.5%. Notably, this figure represents the lowest level recorded by the British Consumer Price Index since September 2021. Similarly, core inflation, excluding energy and food components, experienced a year-on-year decline to 4.5%, marking its lowest level since January 2022, albeit slightly missing the market consensus of 4.6%.

In response to this data, the sterling/dollar pair exhibited a modest decline to $1.2719, compared to the opening price of trading on Wednesday at $1.2721. At its lowest point during the current trading day, the pair dipped to $1.2698 from $1.2729.

While the British Central Bank and policymakers welcomed the deceleration in the inflation rate, they refrained from prematurely declaring victory in the battle against inflation. Instead, they underscored the importance of corroborating this victory through wage data.

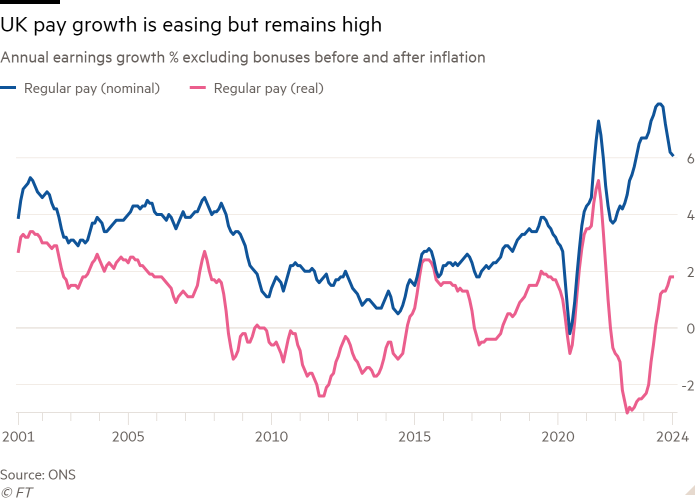

Recent official labor market data highlighted concerning trends, with slowing wage growth and a rise in unemployment benefit claims. According to the Office of National Statistics (ONS), the rate of change in employment decreased to 16.8 thousand applications, falling short of expectations set at 20.3 thousand applications. Additionally, the quarterly average gain declined to 5.6%, missing expectations of 5.7%, and trailing the previous reading of 5.8%.

Moreover, the UK unemployment rate saw a slight uptick to 3.9% in the three months leading up to January 2024, compared to 3.8% recorded in December and market projections of 3.8%.

Despite these concerning labor market indicators, the British Central Bank remains cautious about making decisions regarding interest rate reductions. Their stance is anchored in the anticipation of stable wage growth rates, which are expected to remain above levels consistent with the bank’s target inflation rate of 2%. As such, policymakers are likely to maintain a watchful eye on wage data as they navigate through evolving economic dynamics and inflationary pressures.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations