Global financial markets have experienced sharp volatility in recent weeks, driven by a combination of intertwined factors. Chief among them are concerns over disruptions in artificial‑intelligence–related stocks, a surge in technology spending, and a noticeable decline in investor appetite for riskier, actively traded assets. These themes form the core of this week’s market summary.

Despite the turbulence, the weakness has remained largely confined to the technology sector and has not spilled over into the broader market. In contrast, traditional “old‑economy” sectors—such as industrials, energy, and basic materials—have begun to take the lead. Investors are rotating toward these sectors and away from crowded growth stocks whose valuations have become stretched.

This shift reflects a clear preference for stability and value, especially as economic indicators point to improving growth prospects and a revival in industrial activity. The industrial cycle appears to be gaining momentum, enhancing the appeal of these sectors. As enthusiasm for tech stocks fades—after years of dominating market performance—attention is turning toward industries tied to real economic expansion and supported by government infrastructure spending and rising global demand for goods and services.

This change in sentiment may prompt a rebalancing of investment portfolios, reducing exposure to technology in favor of sectors more closely linked to underlying economic activity. At the same time, technology companies face mounting challenges in sustaining previous growth levels amid intensifying competition and increasing regulatory pressure.

Corporate earnings also contributed to the gains in U.S. equities. Palantir shares rose more than 5% after issuing revenue guidance for 2026 that far exceeded expectations, while Teradyne surged over 13% following first‑quarter revenue projections that beat analyst estimates.

Economic Data

The U.S. dollar came under pressure last week after the ADP non‑farm employment change for January showed an increase of only 22,000 jobs—well below market expectations of a 45,000 gain.

The University of Michigan’s Consumer Sentiment Index for February unexpectedly climbed to a six‑month high of 57.3, compared with expectations of a decline to 55. One‑year inflation expectations fell to 3.5%, the lowest in 13 months, while 5–10‑year expectations rose to 3.4%.

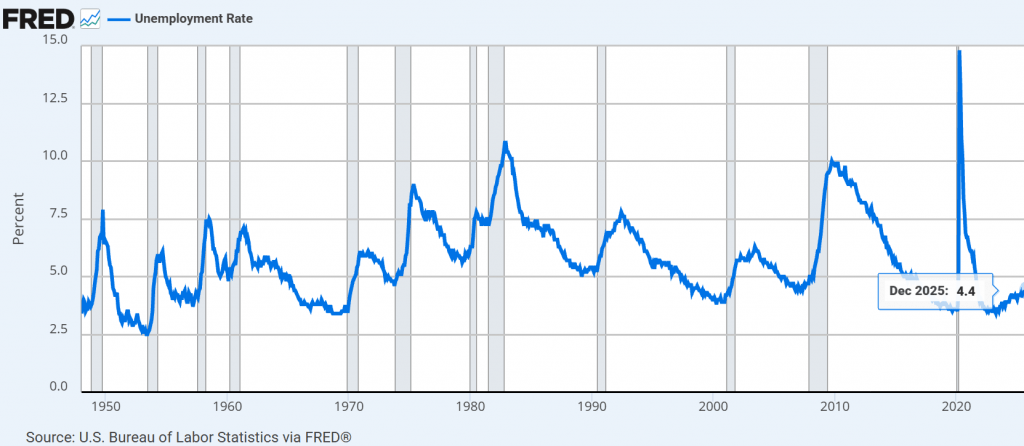

Weekly jobless claims increased more than expected to an eight‑week high, while December JOLTS job openings unexpectedly fell to a 5.25‑year low—both developments supportive of potential rate cuts.

Layoffs surged 117.8% year‑on‑year in January to 108,435, the highest level since January 2009. Jobless claims rose by 22,000 to 231,000—again the highest in eight weeks—signaling further labor‑market softening. JOLTS openings dropped by 386,000 to 6.542 million, the lowest in more than five years, versus expectations of a rise to 7.25 million.

The U.S. Dollar and the End of the Government Shutdown

The dollar posted modest gains as cautious optimism spread following the end of the U.S. government shutdown. The currency also benefited from market volatility, which pushed investors to liquidate assets—including U.S. equities and even cryptocurrencies such as Bitcoin—to raise cash.

President Donald Trump quickly signed the bill ending the shutdown after it narrowly passed the House of Representatives by a vote of 217–214. He described the legislation as “a major victory for the American people.”

The House had earlier voted to end the shutdown by approving 11 annual appropriations bills funding government agencies and programs through September 30, 2026. Trump then signed a $1.2 trillion funding package, officially ending the partial shutdown that began over the weekend.

This development comes as Congress prepares for another contentious debate—this time over funding the Department of Homeland Security.

The dollar also drew support from Trump’s nomination of Kevin Warsh as Federal Reserve Chair. Warsh is viewed as more hawkish than other candidates and was known during his 2006–2011 tenure for emphasizing inflation risks.

Economic data, particularly improving consumer sentiment, also supported the dollar. However, gains were limited by signs of labor‑market deterioration and falling inflation expectations.

The dollar faced additional pressure from weak earnings in the technology sector, especially software and AI‑related companies. Software and data‑services stocks fell sharply after Anthropic launched an AI‑powered legal automation tool, triggering a sell‑off across the tech space. Semiconductor and AI‑infrastructure stocks also lost early gains as investors rotated toward sectors more sensitive to economic activity.

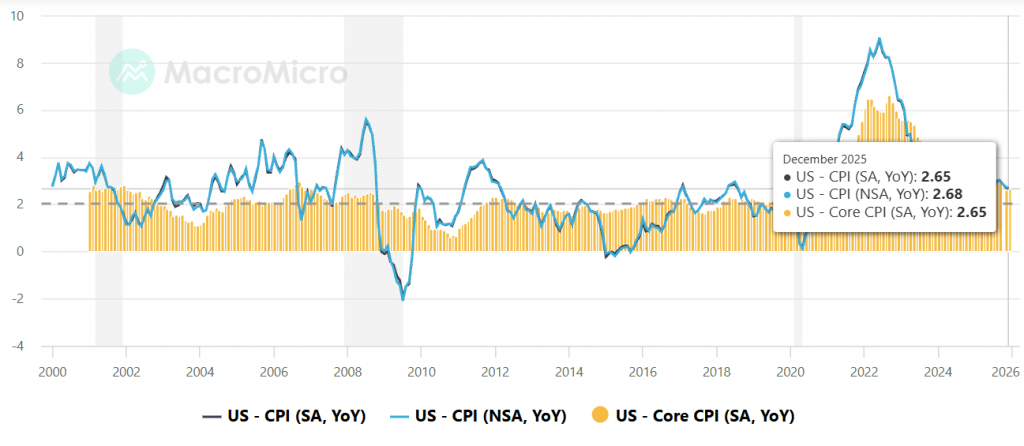

Source: US Bureau of Statistics

The Euro and the European Central Bank

The European Central Bank left its main interest rate unchanged at 2.00% for the fifth consecutive meeting, in line with expectations. The decision was supported by slightly better‑than‑expected eurozone GDP growth and a decline in core inflation (excluding food and energy) to 2.2%, the lowest since late 2021.

Eurozone GDP grew 0.3% in Q4 2025, beating forecasts, while headline inflation fell to 1.7% in January from 2.0% the previous month. This gave the ECB more room to maintain its current stance without immediate action.

ECB President Christine Lagarde reiterated: “We are in a good place, and inflation is in a good place,” a phrase she has repeated since last summer.

The ECB described the eurozone economy as “resilient in a challenging global environment,” citing low unemployment, rising public investment, increased defense spending, and strong private‑sector balance sheets as key supports.

The euro saw little movement after the decision, remaining below 1.181 against the dollar. Lagarde noted that the ECB discussed the dollar’s recent weakness, emphasizing that the trend has been ongoing since March 2025 and is already factored into forecasts.

Markets expect only a 20% chance of a rate cut at the next policy meeting. Although the ECB ended its quantitative‑easing cycle in June 2024, policymakers appear in no hurry to raise rates.

The British Pound and the Bank of England

The pound fell more than 0.5% last week after the Bank of England signaled that quantitative easing remains the most appropriate stance given current economic conditions. The Bank kept its main interest rate at 3.75% at its February meeting.

Despite holding rates steady, the Bank indicated that further cuts are likely due to weak domestic demand and declining inflation. Economic conditions—not political uncertainty—remain the dominant factor shaping policy decisions.

Markets expect additional rate cuts in 2026, consistent with the Bank’s goal of aligning monetary policy with economic realities to support growth after a prolonged tightening cycle.

Weak growth, falling consumer confidence, and a cooling labor market are among the key reasons the Bank favours continued easing.

Cryptocurrencies

Cryptocurrencies posted weekly losses led by Bitcoin, pressured by a broad decline in global risk appetite. Digital assets were also hit by a technical error at a major industry firm, raising concerns about capital security.

Bitcoin and other cryptocurrencies suffered heavy selling as investors fled risk assets. Coinglass data showed $434 million withdrawn from U.S. Bitcoin funds on Thursday, along with $2.1 billion in liquidated short positions within 24 hours.

The Week Ahead

Markets await key U.S. data releases—including unemployment, retail sales, and inflation—which will help clarify the current economic picture. Investors are also closely watching AI‑infrastructure companies ahead of Cisco’s earnings, along with results from the pharmaceutical sector.

Major consumer‑goods companies such as Coca‑Cola and McDonald’s are set to report earnings, as are Ford, Honda, Ferrari, T‑Mobile, and several firms operating cryptocurrency‑trading platforms.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations