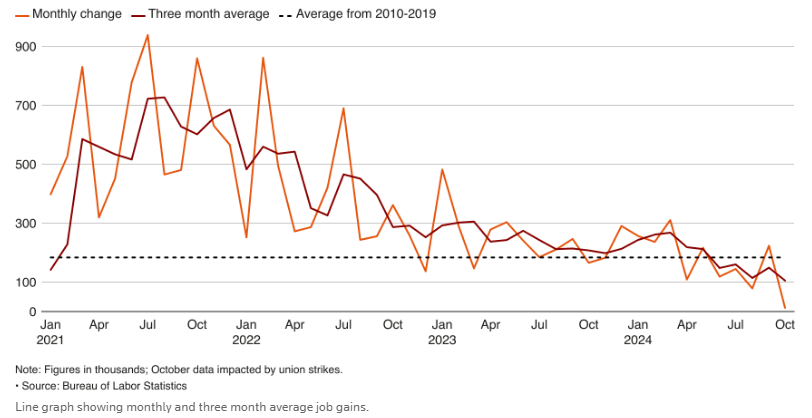

Wall Street roared to life on Friday, propelled by a surprisingly weak October jobs report. The US economy added a mere 12,000 jobs, a stark contrast to the robust growth seen in previous months. This unexpected slowdown ignited hopes that the Federal Reserve might temper its aggressive rate hike trajectory.

The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all opened significantly higher, with the Dow reversing its previous session’s losses. Traders eagerly digested the implications of the soft jobs data, which suggested a potential easing of inflationary pressures.

While the unemployment rate remained unchanged at 4.1%, the sluggish job growth raised eyebrows. This development could signal a cooling labor market, a factor that the Fed closely monitors in its policy decisions. A less tight labor market could reduce upward pressure on wages, thereby mitigating inflationary risks.

In addition to the jobs report, investors also focused on corporate earnings. Tech giants Apple and Amazon delivered mixed results. Apple reported better-than-expected earnings, but a significant tax charge related to a European court ruling dampened its overall performance. Amazon, on the other hand, exceeded expectations, driven by strong growth in its cloud computing and advertising businesses.

Other economic indicators provided a mixed picture of the US economy. Manufacturing activity, as measured by both the S&P Global and ISM manufacturing PMIs, contracted in October. This suggests that the manufacturing sector is struggling amid rising interest rates and global economic uncertainties.

On a more positive note, construction spending edged up slightly in September, primarily due to growth in residential projects. However, the non-residential segment remained weak, reflecting concerns about future economic growth.

Overall, the market’s strong reaction to the soft jobs report and positive corporate earnings highlights investors’ optimism about a potential shift in monetary policy. However, uncertainties surrounding the global economic outlook and geopolitical tensions continue to pose risks to the market’s upward trajectory.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations