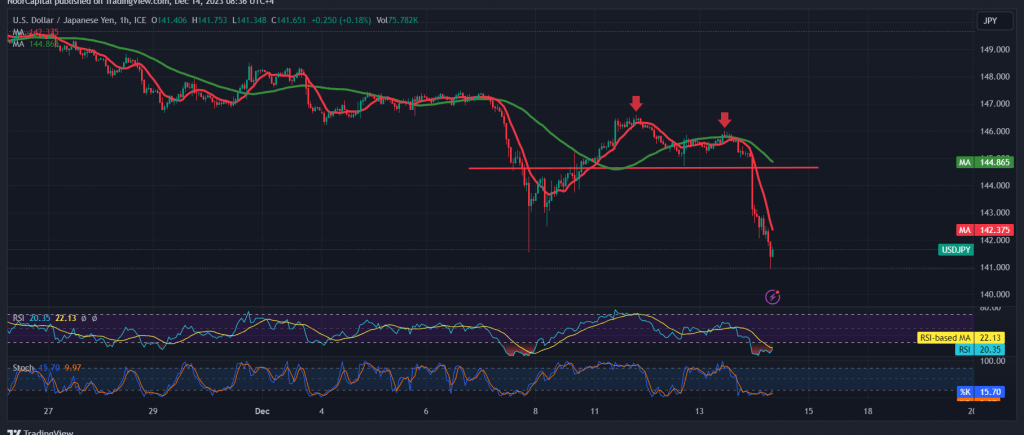

The USD/JPY pair sustained its losses as anticipated in the previous technical report, surpassing the official targets set at $143.90 and reaching its lowest level at $140.95.

From a technical perspective today, signs point towards the potential continuation of the downward trend. This is supported by the ongoing formation of simple moving averages exerting strong negative pressure on the price from above. Additionally, the pair has successfully confirmed the breach of the support level at $142.40.

Therefore, our belief is that the pair may persist in its decline, especially if the price falls below $140.95, with a target set at $139.70, the next official station, as long as trading remains stable below $142.40.

It is essential to note that consolidation above $142.40 could lead to a temporary recovery for the pair, allowing it to revisit $144.75.

Cautionary Note: The risk level may be high, and the quality of the trade may not align with the expected return. Today, we are anticipating high-impact economic data from the British economy, including the Monetary Policy Summary, Interest Rate Decision, and Monetary Policy Committee vote on interest rates. Eurozone economic data includes Interest Rate Decision, ECB Monetary Policy Statement, and ECB President’s press conference. From the United States, focus is on US retail sales.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations