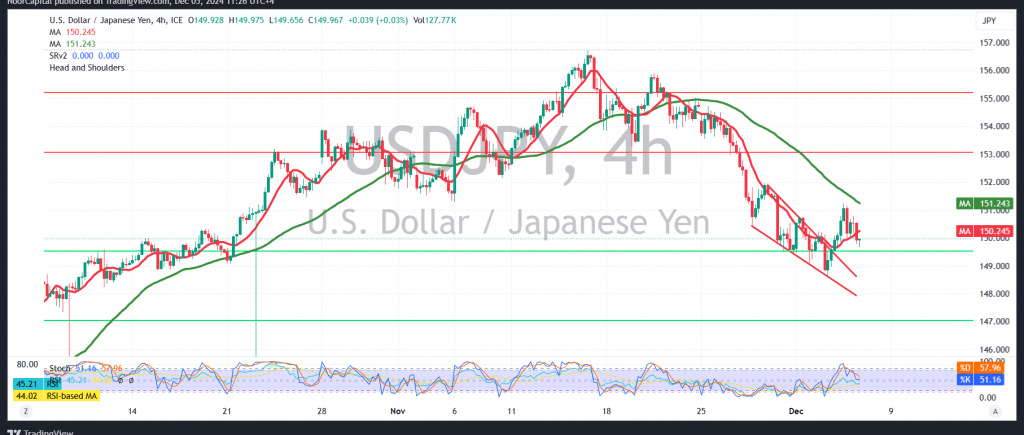

The USD/JPY pair maintained its bearish momentum as anticipated, showing a gradual decline toward the initial target of 149.10, with the pair reaching a low of 149.50.

Technical Analysis:

- Bearish Indicators:

- The 50-day simple moving average (SMA) continues to exert downward pressure, supporting the continuation of the bearish trend.

- However, the Relative Strength Index (RSI) is attempting to generate positive signals, introducing a degree of uncertainty.

Scenario Analysis:

- Bearish Continuation (Most Likely):

- A break below 149.10 would strengthen the downward trend, with the next targets at 148.50 and 147.50.

- Bullish Reversal:

- To confirm a bullish scenario, the pair must breach the key resistance levels at 150.85 and 151.20.

- A break above these levels would pave the way for upward targets at 151.90 and 152.50.

Key Considerations:

- High-Impact Economic Data:

- The release of U.S. Weekly Unemployment Claims today could significantly influence market movements, leading to heightened volatility.

- Risk Warning:

- Elevated risk persists due to ongoing geopolitical tensions, necessitating cautious trading strategies as all scenarios remain possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations