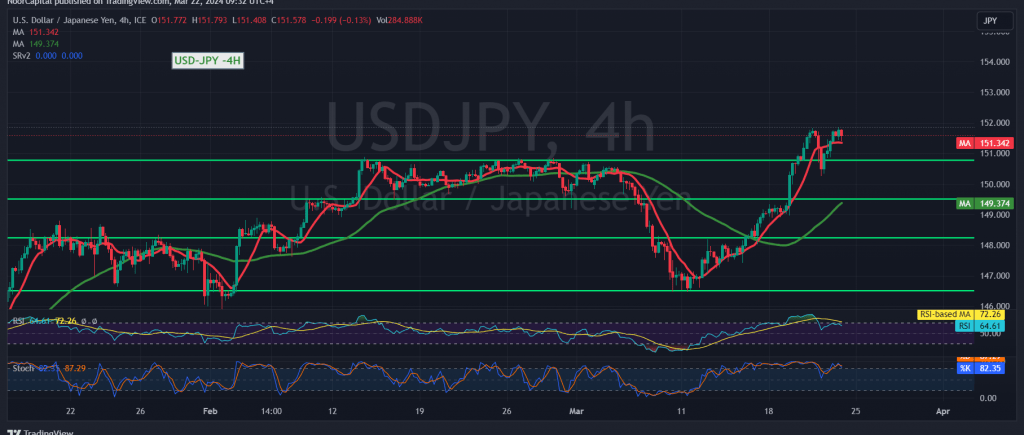

An upward trend persists in the movements of the USD/JPY pair, aligning with the positive outlook outlined in the latest technical report, reaching its peak at 151.86.

From a technical perspective today, examining the 240-minute chart reveals that the USD/JPY pair has found robust support around 150.60, bolstering the potential for further upward movement, supported by the positive influence of the simple moving averages. However, it’s worth noting that the 14-day momentum indicator is signaling negativity on shorter time frames.

Given these conflicting technical signals, we opt to temporarily monitor the pair’s price behavior, anticipating one of the following scenarios:

- Breakout above 151.85: This would likely motivate further upward movement, with targets set at 152.20 and 152.80 respectively.

- Dip below 150.60: Such a move could prompt the pair to resume its downward trajectory, with initial targets starting at 149.65, completing the bearish path.

Warning: The risk level may be elevated.

Warning: Today’s trading session may be impacted by a speech from Jerome Powell, Governor of the Federal Reserve, potentially resulting in significant price fluctuations.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations