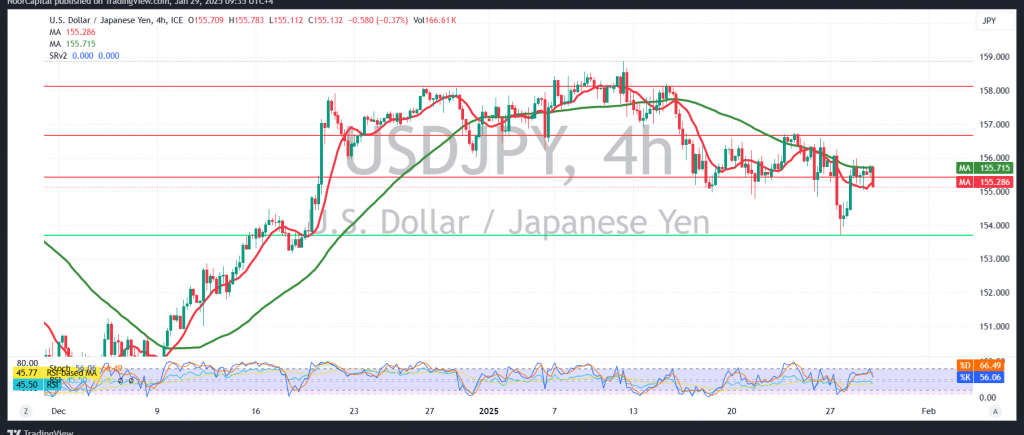

We maintained momentary neutrality in our previous report due to conflicting technical signals, noting that breaking 154.80 would expose the pair to downside pressure, targeting 154.30, with the price recording a low of 154.40.

Technical Outlook:

Today, the conflicting signals remain valid, with price action confined within a narrow range—trading above 155.00 but below 156.00.

Given this setup, we prefer to monitor price behavior carefully. A break below 155.00 may trigger further downside pressure, targeting 154.40 and potentially 153.70. Conversely, consolidation above 156.00 could reinforce bullish momentum, pushing the pair toward 156.70.

Caution: Market participants should be aware of upcoming high-impact economic data, including the U.S. Federal Reserve statement, Fed Chair press conference, and interest rate decision, alongside Canada’s interest rate announcement and Bank of Canada monetary policy statement. Expect increased price volatility during these events.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations