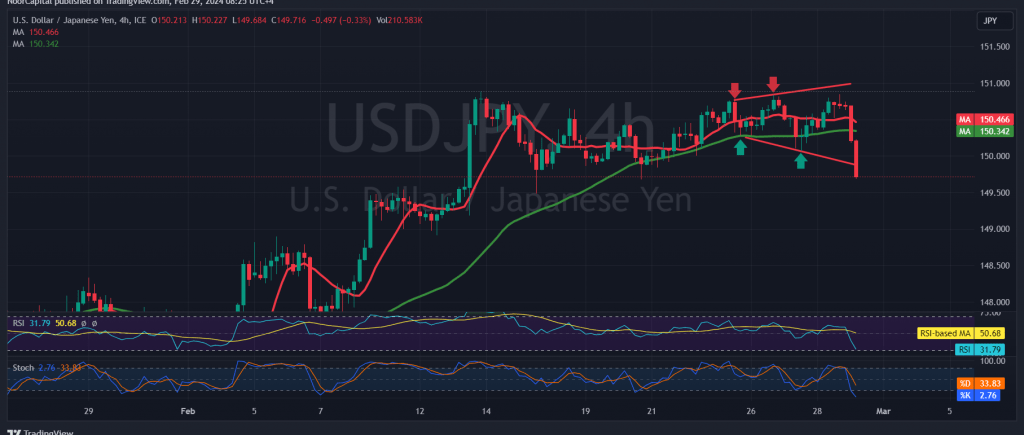

The USD/JPY pair deviated from the anticipated upward trajectory outlined in the previous technical report, as trading stability above the 150.10 level couldn’t be maintained. The significance of the 150.80 resistance level highlighted in the prior report became evident, exerting formidable downward pressure on the pair’s movements. With a dip below 150.00, the pair reached its lowest point of 149.71 during early morning trading.

Today’s technical analysis paints a bearish picture, as trading stability falters below the robust support of 150.00. Moreover, the negative pressure from the simple moving averages, now pushing the price from above, reinforces this sentiment.

Consequently, the prevailing bias leans towards a bearish trajectory, with the initial target set at 149.35. A breach at this level would extend the pair’s losses, opening the path directly towards 148.95, with further declines potentially reaching 148.40.

In summary, unless there’s a significant shift with trading above 150.80, the downward trend is expected to persist in the immediate term. However, breaching this level could pave the way for a recovery towards 151.25 and 151.70 initially.

A word of caution: Today’s trading activity may see heightened volatility due to the impending release of high-impact economic data from the American economy, specifically the annual and monthly basic personal consumption spending prices, along with the weekly unemployment benefits. Consequently, the risk level may be elevated. Traders are advised to exercise caution during this period.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations