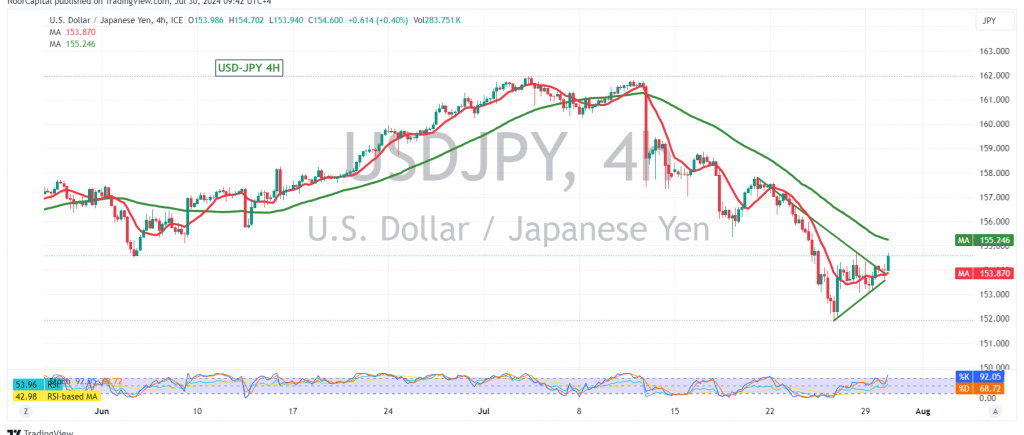

The dollar-yen pair experienced negative trading in the previous session, reaching a low of 153.00, effectively halting the downward trend.

From a technical analysis standpoint, today’s intraday movements show an upward rebound, likely due to the psychological support at 153.00. However, the Stochastic indicator is beginning to show negative signals, suggesting overbought conditions.

Given these indicators, the continuation of the decline is probable, particularly if there is a clear break below the support level of 153.50. This could lead to a retest of 153.00, and a further break below this level may accelerate the downward trend, targeting 152.40 and 151.80 initially.

Conversely, if the pair stabilizes above 155.20, it could halt the downtrend entirely, potentially leading to a recovery towards 155.80, with further gains extending to 156.80.

Caution: The level of risk is high and may not align with the expected return. Additionally, the release of the “Consumer Confidence” report from the US could result in significant price fluctuations.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations