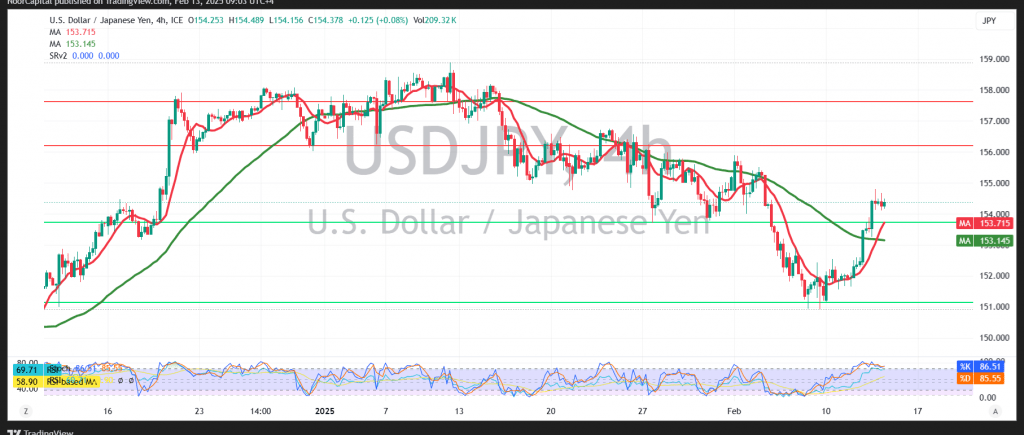

The USD/JPY pair experienced mixed movements, ultimately invalidating the previous downward correction as it stabilized above the 153.70 resistance level.

Technical Outlook:

- Bullish Factors:

- Price is above the simple moving average, suggesting continued upward momentum.

- Bearish Signals:

- Stochastic indicator is in the overbought zone, indicating potential overextension.

- Key Scenarios:

- Bullish Breakout:

- A confirmed breach of 155.00 could push the pair higher towards 155.30 and 156.30.

- Bearish Breakdown:

- Falling below 152.80 may trigger strong downside pressure, targeting 151.50.

- Bullish Breakout:

Market Risks & Considerations:

- High-impact US economic data (Producer Price Index, Weekly Unemployment Claims) may drive significant price volatility.

- Trade tensions remain a major risk factor, increasing uncertainty.

⚠ Risk Warning: The market is highly volatile, and all scenarios remain possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations