Sharp price fluctuations dominated the trading of the dollar/yen pair yesterday, affected by the decision of the Bank of Japan, recording its lowest level at 160.21, which is the lowest since 1990.

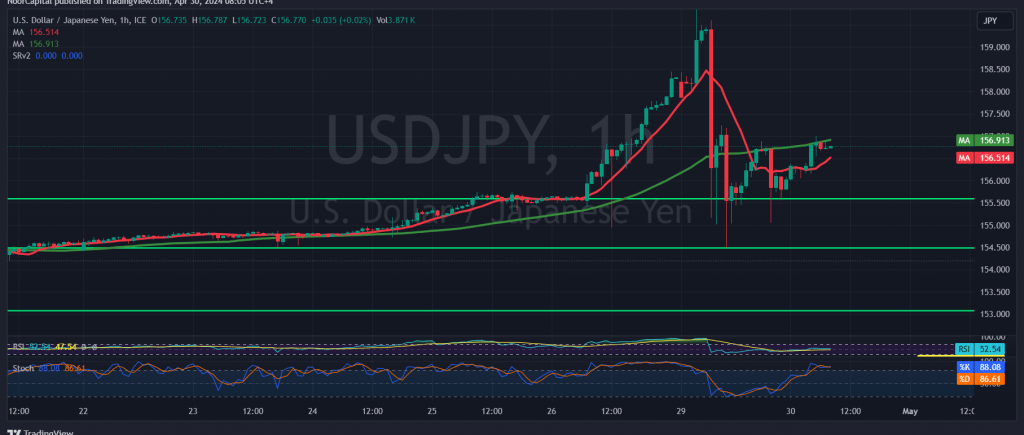

On the technical side today, we notice a conflict between the technical signals, and we find that the 50-day simple moving average continues to carry the price from below, and on the other hand, the Stochastic indicator has begun to send negative signals.

We prefer to monitor the price behavior of the pair to be faced with one of the following scenarios:

The upward trend depends on confirming the breach of 159.80, and this may open the way for the pair to record additional gains starting at 162.85, while sneaking below 155.60 constitutes a negative pressure factor that increases the possibility of visiting 154.40.

Warning: The risk level is high and is not proportional to the expected return and we may witness more severe price fluctuations.

Warning: Today we are awaiting high-impact economic data issued by the American economy, “Employment Cost Index, Consumer Confidence Index,” and we may witness high fluctuation in prices at the time of the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations