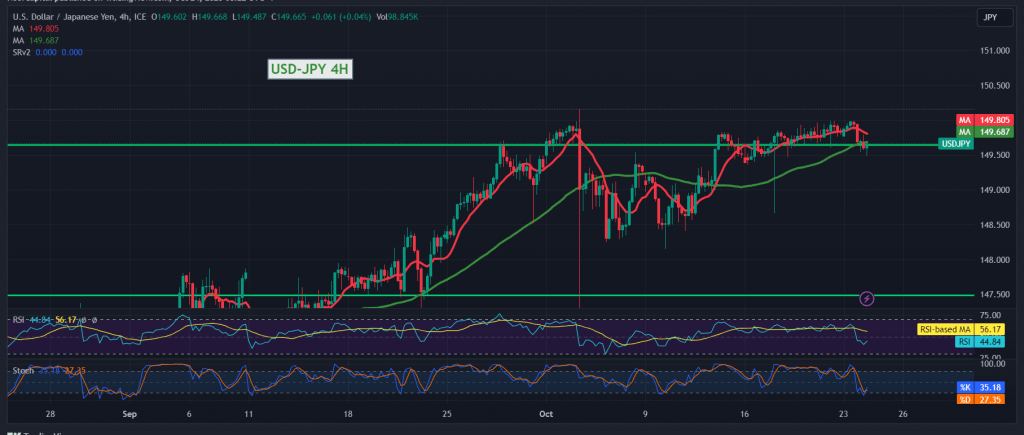

The USD/JPY pair found a strong resistance level around the psychological barrier of 150.00, which forced the pair to trade with clear negativity during the previous trading session, and it is currently hovering around 149.65.

Technically, we tend towards negativity in our trading, relying on the beginning formation of simple moving averages and negative pressure on the price. This comes with the clear negative signs on the Stochastic indicator, which has begun to lose upward momentum.

From here, with daily trading remaining below the psychological barrier of 150.00, the downward trend is most likely during the day, targeting 149.40. Breaking it will facilitate the task required to visit 149.00. You must pay close attention to the aforementioned level because breaking 149.00 will lead the pair to further decline towards 148.60.

Trading stability and price consolidation again below 150.00 will stop the chances of a decline, and we may witness an upward trend whose goal is to retest 150.40 and then 151.00.

Note: Today we are awaiting high-impact economic data from the Eurozone, the services and manufacturing PMI indexes from Germany and France, and the services and manufacturing PMI indexes and unemployment benefits from the UK.

In the US, the markets await the services and manufacturing PMI index, and we may witness some volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations