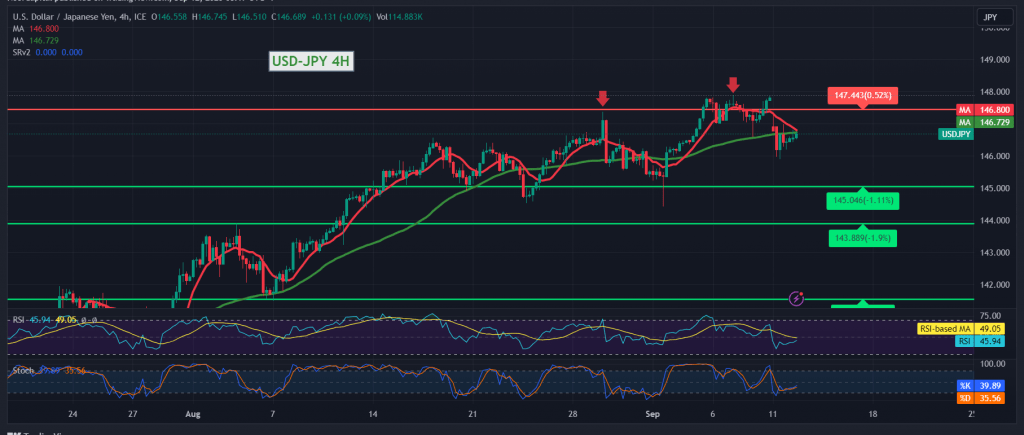

The dollar/yen pair declined significantly during the first trading sessions of this week after several successive sessions of ascent, hitting the resistance level of 147.80 and returning to negativity, recording its lowest level of 145.90.

On the technical side, today the simple moving averages returned to pressure the price from above and support the possibility of resuming the daily downward trend. This comes with the signs of negativity appearing on the Stochastic indicator.

Therefore, the possibility of a bearish bias occurring during the coming hours is still valid and effective, knowing that sneaking below 145.90 will facilitate the task required to visit 145.75 and 145.55, respectively.

From above, we can cross upwards and rise again above 147.00 with the closing of the candle for at least an hour. This will immediately stop the proposed bearish scenario and we will witness a retest of 147.65 before determining the next price direction.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations