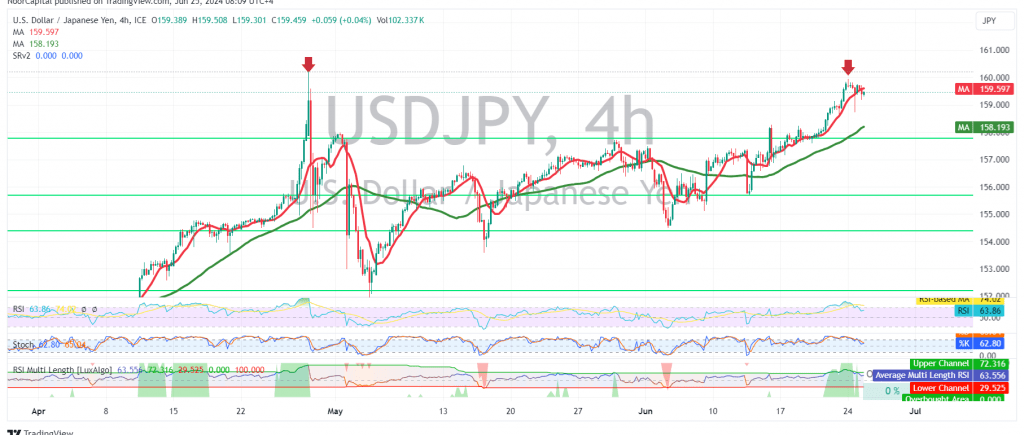

The USD/JPY pair has successfully achieved its first official target of 159.85, reaching a high of 159.93 and nearing the psychologically significant level of 160.00.

Technical Outlook:

On the 240-minute chart, the 160.00 level is acting as a strong resistance point, potentially limiting further upward movement in the short term. The Stochastic oscillator is also exhibiting negative signals, suggesting a possible correction.

Potential Correction:

As long as the price remains below 160.00, we may witness a corrective drop towards 158.85 initially, with a possible extension to 158.20. However, this correction would not invalidate the overall upward trend.

Upward Potential:

A break above the 160.00 resistance level would open the way for further gains, with targets at 160.60 and 161.20.

Key Levels:

- Resistance: 160.00, 160.60, 161.20

- Support: 158.85, 158.20

Important Note:

The release of the U.S. Consumer Confidence Index today could significantly impact the pair’s movement. Traders are advised to exercise caution and closely monitor the market’s reaction to this data.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations