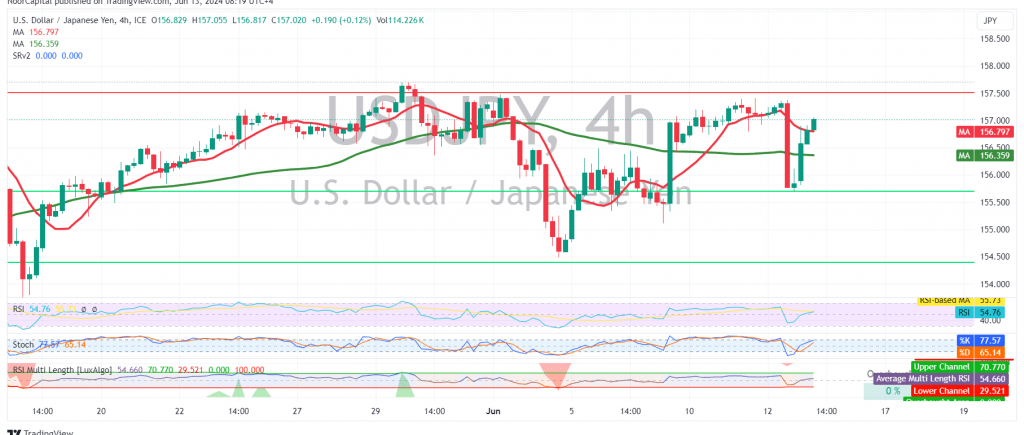

The USD/JPY pair experienced mixed trading in the previous session, but managed to maintain its overall bullish trajectory. On the 240-minute chart, the pair is holding above the crucial support level of 156.60, with simple moving averages providing continued positive momentum for the upward price curve.

Outlook and Trading Strategy:

As long as the price remains above 156.60, the upward trend remains valid. Our initial target is 157.70, followed by a potential extension towards 158.40. The ultimate target for this current wave is around 159.40.

However, traders should exercise caution as a drop below 156.60 could trigger a bearish reversal, with initial targets around 156.00, potentially extending to 155.50.

Important Note:

The release of high-impact U.S. economic data today, including annual producer prices and basic monthly/annual producer prices excluding energy and food, could induce significant price volatility. Additionally, the inherent risk level in the forex market remains high.

Key Levels:

- Support: 156.60

- Resistance: 157.70, 158.40

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations