The Japanese Yen fell sharply in the previous trading session, influenced by the Bank of Japan’s decision to raise interest rates, reaching a low of 148.50.

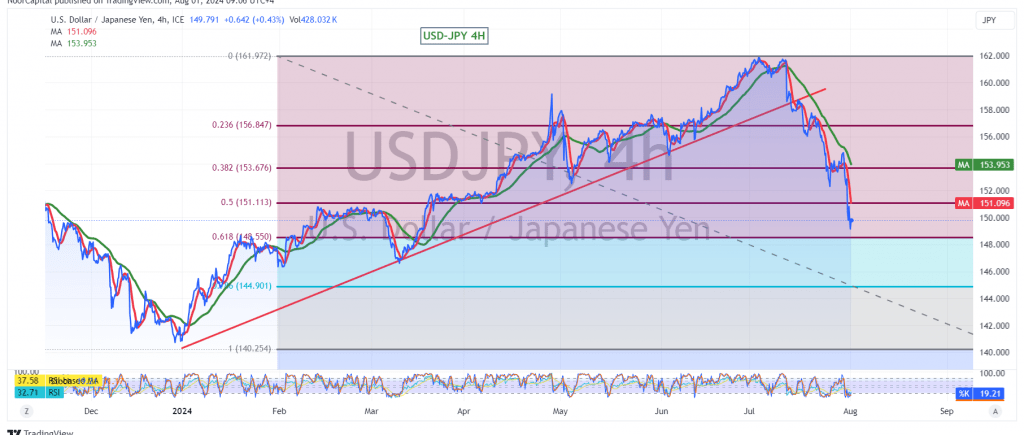

From a technical perspective, the 240-minute chart shows negative crossovers of the simple moving averages, applying downward pressure on the price. Additionally, the pair has broken below the pivotal support level of 151.10, which has now turned into resistance.

Given these conditions, the continuation of the decline appears likely, with potential targets at 147.50 and 145.30.

However, if the pair stabilizes above the 151.10 resistance level, this could halt the downward trend and lead to a recovery towards 152.90.

Caution: The risk level is high and may not align with the expected return. Additionally, today’s high-impact economic data releases from the British economy, including the interest rate decision, monetary policy summary, MPC vote on interest rates, and a speech by the Bank of England Governor, as well as US data on unemployment benefits and manufacturing PMI, could lead to significant price volatility.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations